Mitigating the risk of concentration in the display business

Supplying of assembly and post-processing equipment at domestic and foreign markets

Secondary batteries taking up more than half of the ord

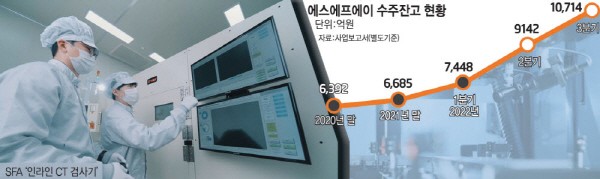

SFA's orders on hand exceeded 1 trillion KRW in 5 years. The business diversification strategy focused on secondary batteries was effective. More than half of the order backlog came from the secondary battery sector. As the existing order backlog is recognized as sales, SFA's sales this year are expected to grow by about 10% from last year.

As of the last third quarter, SFA's order backlog reached 1.714 trillion KRW. It is the 22ndquarter (5 years and 6 months) that SFA has exceeded 1 trillion KRW in order backlog, following the first quarter of 2017 when it achieved 1.49 trillion KRW. In the same year, SFA recorded their highest consolidated sales of 1.92 trillion KRW. At the time same, display sales accounted for 86%.

SFA has used secondary batteries, semiconductors, and distribution as their growth engines. This is to mitigate the risk caused by the concentration in the display business. This year, orders for secondary batteries increased.

Earlier this year, SFA supplied assembly process equipment for the first time to a domestic battery company, such as notching equipment that cuts electrode plates to a certain size and stacking equipment that stacks the cut electrodes upward. In the summer, they signed a contract to supply back-end process equipment and logistics facilities worth about 170 billion KRW to a European cell maker.

Demand for in-line CT inspection machines that can be applied to secondary battery mass production to inspect the entire assembly state, and artificial intelligence (AI) exterior inspection machines that have raised detection accuracy to 95% are also increasing. The secondary battery segment accounted for 51.2% of SFA's order backlog in the third quarter, at 549.4 billion KRW. The number of employees also increased by 45 from the previous quarter to 672.

The securities industry predicted that the existing order backlog would be recognized as sales in earnest from the fourth quarter, and SFA's sales this year would be around 1.75 trillion KRW. This is an increase of about 10% compared to last year's sales of 1.565 trillion KRW. As there are many cases that are not included in the order announcement, it is expected to be able to achieve 2 trillion KRW in sales next year at the earliest.

SFA plans to continue expanding their secondary battery, semiconductor, and distribution businesses. They aim to increase sales of secondary battery equipment by participating in overseas plant orders in the domestic battery industry. SFA was also selected as a degassing equipment supplier for the SK on Hungary plant in April. In September, a new subsidiary was established in Sweden to respond AS to overseas customer.

The distribution and smart factory fields, where large-scale logistics centers for customers are newly established, are also expected to continue growing. They will respond to demand with an intelligent logistics with turnkey system.

An official from SFA said, “Orders are expected to increase focusing on the growing secondary battery industry. We will preemptively develop equipment based on core technologies and secure a mid to long-term growth foundation centered on secondary batteries, distribution, and semiconductors.”

By Staff Reporter Yun-sub Song (sys@etnews.com)