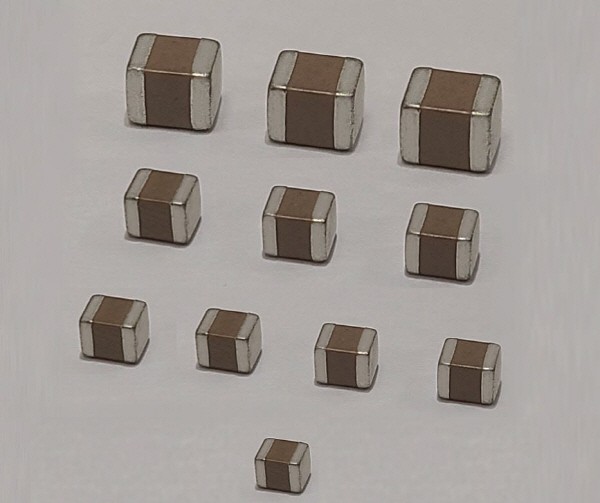

Demand for multilayer ceramic capacitors (MLCC) is expected to slow down until the first half of next year. The trend is likely to be concentrated in the IT sector, including smartphones, PC, and tablet PC. On the other hand, MLCC for electric vehicles and automobiles are expected to continue to grow rapidly. The domestic MLCC industry plans to respond to market changes by lowering the operating rate and increasing the proportion of special MLCC.

Samsung Electro-Mechanics' component division, which is in charge of MLCC, is expected to generate sales of 4.166 trillion KRW this year, which is decreased by about 14% from 4.778 trillion KRW last year. Most of Samsung Electro-Mechanics' MLCC business is for IT devices.

The operating rate also plummeted. The component division's operating rate in the third quarter was only 65%. It is the lowest rate in last three years since 2019. Last year, when MLCC was booming, the utilization rate was between 89~99%.

Samsung Electro-Mechanics has recently been significantly increasing MLCC for automotive and industrial use. They are struggling to secure large global customers. They announced that their automotive MLCC business in the third quarter of this year grew by double digits compared to the previous year. As MLCC accounts for a large portion of total sales, it is known that they are struggling with special measures to respond to a sharp drop in demand.

Samwha Capacitor also recorded 60.3 billion KRW in sales in the third quarter, down 14.16% from the previous year. Net profit was 8 billion KRW, down 30.21% from the previous year. The Yongin plant's operating rate is in the 70% range, down from 93% last year. The overseas plant operating rate was 59%, down significantly from 89% last year. Samwha Capacitor's MLCC business has a high proportion of IT and home appliances. Samwha Capacitor is diversifying their sales by strengthening the automotive MLCC business, where demand continues to grow.

Murata from Japan announced that MLCC demand will decline until the first half of next year due to the decline in smartphone sales in China. The prediction of the world's No. 1 company becomes the standard for the MLCC industry. Smartphone and PC, and tablet PC shipments for next year were predicted to decrease by 19.9% and 12% compared to last year to 1.1 billion units and 440 million units, respectively.

On the other hand, automotive and industrial MLCC is on the rise. AMOTECH, which is strengthening automotive MLCC, succeeded in turning a profit on a separate basis in the third quarter of this year from MLCC sales. The proportion of MLCC sales is expected to increase further next year. An annual turnaround is expected next year. For AMOTECH, demand for MLCC for global electric vehicle manufacturers and communication equipment is continuously increasing.

AVATECH opened the door to a new special MLCC business this year by supplying MLCC to SolarEdge, the world's number one solar inverter company. AVATECH mass-produced and supplied MLCC for industrial, electronic products, and IT purposes. Negotiations are underway to supply MLCC parts for automotive electronics.

An official from the parts industry said, “The demand for MLCC for IT has noticeably declined and the price has also fallen, so companies are making breakthroughs in growth markets such as for electric vehicles. As the MLCC production lines for IT and automotive are different, additional investment is required.”

By Staff Reporter So-ra Park (srpark@etnews.com)