Growth in large, medium and small enterprises

Establishment of a non-contact culture since the pandemic

Spread of DX awareness and public projects

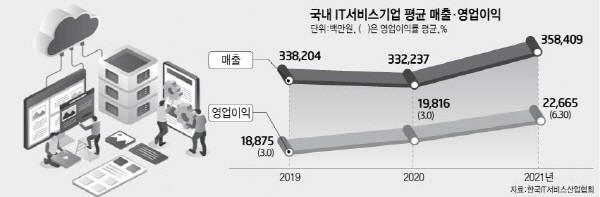

Sales of domestic information technology (IT) service companies increased by 7.9%, and operating profit by 14.4% in 2021 compared to the year before. Increase in demand for digital transformation and the spread of cloud adoption due to COVID-19 are the reasons for the increase in sales and profit.

Korea Information Technology Service Industry Association (ITSA) published the '2021 IT Service Company Handbook', which introduced detailed information such as the current status of each domestic IT service company and major services.

The IT service company handbook has been published since 1993 as a specialized IT service sector handbook that introduces and publicizes IT service companies comprehensively in their business performance and supply capabilities.

The average sales of IT service companies in 2021 were KRW 358.4 billion and the average operating profit was KRW 22.7 billion, which is 7.9% and 14.4% increase, respectively, from the previous year according to a survey of 217 domestic IT service companies.

There were 12 companies with sales more than KRW 800 billion, which is the same number as the previous year. There were 36 companies with sales between KRW 200 billion to KRW 800 billion, which is 2 more than the previous year.

Despite having 1 less company with an operating profit of KRW 30 billion or more compared to last year, the operating profit of IT service companies recorded growth with the increase in number of companies with an operating profit of KRW 10 billion - KRW 30 billion increased by 4, and the number of companies with an operating profit of KRW 2 billion - KRW10 billion won increased by 30.

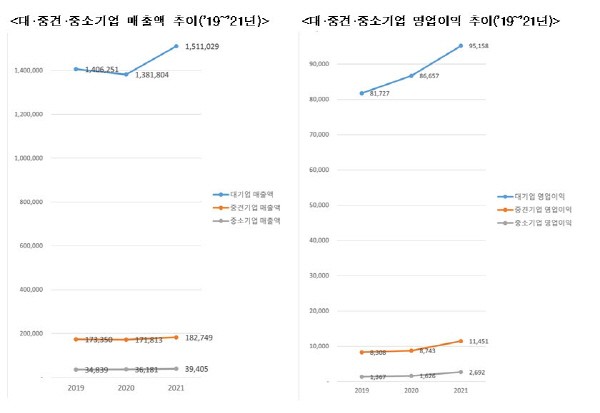

The significant increase in sales and operating profits of all IT service conglomerates, medium-sized enterprises, and small and medium-sized enterprises (SMEs) are something that should be noted in 2021.

When analyzing the three-year trend from 2019 to 2021, the average sales of large and medium-sized enterprises decreased slightly in 2020 compared to 2019, but recovered in 2021. The average sales of SMEs increased gradually over the past three years, and the average operating profit of large, medium-sized, and SMEs continued to increase during the same period.

It is analyzed that the next-generation information system construction project has been ordered in the public sector, and the demand for digital transformation (DX) has increased in the private sector, such as cloud conversion and smart factory construction.

The pandemic of COVID 19 that began in 2020 was the rise of non-contact culture that increased awareness of corporate digital transformation.

The operating profit rate of large and medium-sized enterprises in 2021 was 6.3%, and that of SMEs was 6.8% when analyzing the large, medium, and small businesses. The companies with large sales have relatively high operating margins among large, medium-sized, and small- and medium-sized enterprises.

An unusual phenomenon in medium-sized enterprises was that the companies with the lowest in sales, less than KRW 30 billion, had the highest operating margin at 10.3%. In the case of foreign medium-sized enterprises had high rates in sales and operating profit. The companies with sales between KRW 30 billion - KRW 60 billion had the highest operating profit rate at 8.1% for SMEs.

The 2021 IT Service Company Handbook can be downloaded for free from the ITSA website. ITSA plans to distribute handbooks to more than 1,500 government agencies, local governments, public corporations and government-invested institutions, and financial institutions.

Korea IT Service Industry Association plans to revise the handbook contents of the IT service industry definition, classification system, and industrial structure in the future to complement the latest trends. One of the main agendas of the association's activities in 2023 is to form a separate advisory committee within the association as part of 'enhancing the status of the IT service industry’.

By Staff Reporter Ho-cheon An (hcan@etnews.com)