The sudden decline in foundry demand is due to the collapse of the downstream industry. For system semiconductors manufactured by foundries, the main markets are finished products such as smartphones, PCs, servers, home appliances, and automobiles. Samsung Electronics and Apple are expected to reduce shipments of smartphones next year. Samsung Electronics is expected to ship 260 million units, a decrease of 10 million units from the previous year. Apple is also adjusting iPhone 14 shipments to reflect declining demand. The PC market and home appliance market also saw a clear decline in sales.

There is also a ‘red light’ in the server and data center market, which was believed to have solid growth due to the increase in data processing volume. Morgan Stanley analyzed that the top 10 US cloud companies' facility investment this year increased 25% annually through the first half of this year but predicted that next year's facility investment would grow only 5%.

In fact, data center companies such as Amazon Web Services (AWS), Google, Microsoft (MS), and Meta will increase their facility investment until this year but are expected to narrow the increase from next year. This means that high value-added products cannot generate greater demand than expected in the server-oriented semiconductor market.

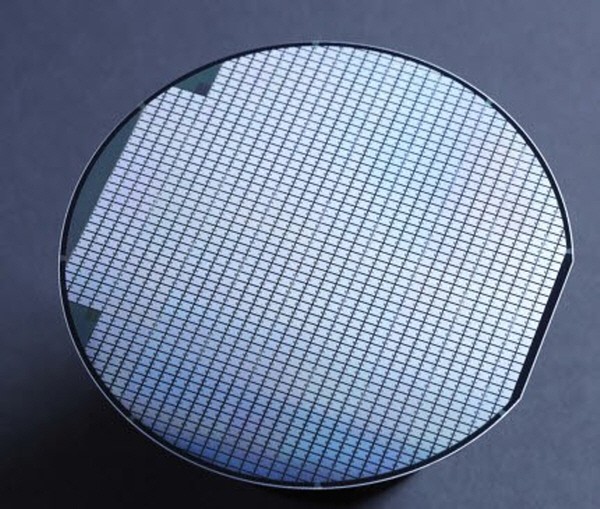

A 'dark age' for foundries next year is predicted not only in Korea but also abroad. According to Taiwanese media recently, TSMC orders have been on the decline since the end of September. The decline in orders is expected to continue through the first quarter of next year. This is largely due to the fact that core customers such as Nvidia, MediaTek, and AMD reduced their order volume.

40-50% of orders for 3-nanometer process semiconductors, which TSMC is preparing for mass production at the end of the year, have also been canceled. TrendForce, a market research company, analyzed that the 8-inch foundry utilization rate fell to 90% in the second quarter, but announced that the 4-7 nano-level advanced process (12-inch) maintained at utilization rate of 95-100% although difficult to maintain.

Samsung Electronics, the world's second-largest foundry, also predicted a market recession next year. At the conference call in the third quarter, they expected to achieve the highest sales and profits by this year, but said, "Demand will slow in the first half of 2023 due to macro (macroeconomic) uncertainty, economic slowdown and inventory adjustments for customers." Another problem is that the industry is not doing well due to high inflation, the Russia-Ukraine war, and the US-China war for hegemony in the semiconductor industry,

Some are expecting a turnaround in the foundry market in the second half of next year.

However, as it is difficult to predict how long macroeconomic uncertainty will last, it is urgent to come up with a new survival strategy. The foundry industry is risking its vitality to secure new customers in response to the unprecedented decrease in demand. An official from the foundry industry said, "We are discovering markets that are expected to grow, such as automobiles and the Internet of Things (IoT)."

By Staff Reporter Dongjun Kwon (djkwon@etnews.com)