Coming to a point of meeting the limit, ’Six-month pre-order' at risk

Direct blow on system semiconductor economic

Steady increase in raw material prices

Decrease in demand next year... gloomy outlo

The demand for foundry started to decline. Some plants processes do not reach 100% utilization. This is opposite to the situation when all pre-orders for the year were completed at the beginning of this year. With the memory semiconductor market stagnating, it is forecasted that even the foundry market that is responsible for the system semiconductor ecosystem has started to suffer.

It is inevitable that the market will face decline in earnings as raw material for foundry process prices continue to rise.

The number of foundry process orders of semiconductor fabless companies is declining significantly. Some of them have come to a point of where ‘six-month pre-order’ has not been placed. An official from an 8-inch foundry industry said, “We have not been able to secure all six-month pre-orders to secure the customary foundry process. It is inevitable that demand will decrease next year.” Another official said, "Some processes do not operate in 100% utilization rate. We are responding to existing customer orders; however there is a significant decrease in new orders.”

Some of domestic representative foundries include Samsung Electronics, DB HiTek, and Key Foundry. SK Hynix System IC moved to Wuxi, China, and is focusing on the orders from fabless companies in China rather than in Korea. SK Hynix had received orders for at least six months to a maximum of one year at the beginning of this year. It is experiencing a bottleneck effect from not being able to keep up the production capacity with demand.

The foundry boom did not last half a year. This is because the downstream industries of major system semiconductors such as smartphones and PCs have been hit by the global economic downturn. The outlook for domestic foundry finished products (sets) that will be equipped with semiconductor products, such as power management semiconductor (PMIC), display driving chip (DDI), and radio frequency (RF) chips, has worsened. The bottleneck effect of the demand for automotive semiconductors, such as microcontroller units (MCUs) that has been playing a key role in a healthy finished car market, is also being resolved.

The COVID lockdown situation in China believed to have negative influences in the foundry market. A setback in sales in the China, which is considered the ‘big hand' in the semiconductor market, hampered the export of domestic fabless. The CEO of a fabless company that was supplying automotive semiconductors to China said, “We had no choice but to adjust the production of semiconductor products as sales in China significantly declined. If we do not find another market, we will have no choice but to reduce new orders for foundry market.”

The foundry industry expected that the decline in demand would not be reflected in this year's earnings since there is enough volume to fulfill existing orders. The industry is also benefiting from the result of the high exchange rate. However, a recession is inevitable from next year since the cost of raw materials required for the foundry process is rising while demand is decreasing. An industry official said, “The purchase price of raw materials such as wafers, various materials, and industrial gas rose by 10% every quarter.”

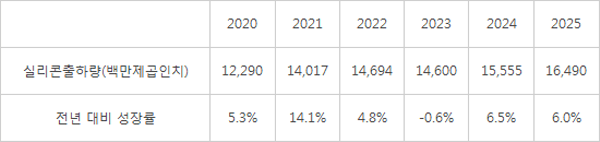

Forecast of Global Silicon Wafer Shipments

Provided by International Semiconductor Equipment and Materials Association (SEMI)

By Staff Reporter Dongjoon Kwon (djkwon@etnews.com)