Causing overall ‘instability in supply chain’ for semiconductors for cutting-edge systems

Demand for autonomous vehicles soars… other factors like mobile AP have bear negative effects

Korean and ov

The shortage of photomasks is highly likely to fuel anxiety in the supply of semiconductors for next-generation automobiles. It could cause instability across the supply chain of semiconductors for cutting-edge systems like smartphone application processors (AP), graphics cards for cutting-edge smart devices, and semiconductors for autonomous driving sensors. If there is an overflow of orders for semiconductors for autonomous driving as the instability of semiconductor supply grows, the instability for the semiconductor production will also grow.

The demand for system semiconductors for autonomous vehicle R&D has been rising rapidly recently. Photomasks are an essential part for the semiconductor manufacturing process. Fabless companies purchase them from mask companies and supply them to foundries, or they may directly pay the foundries to purchase them directly. Unlike memories, system semiconductors are mostly supplied by subcontractors. System semiconductors come from multi-variety, low-volume production systems, which means the shortage of photomasks will lead to setbacks in semiconductor production. An official of a fabless company shared their concerns, saying, “We need 30~45 photomasks for semiconductor development, but we aren’t even able to properly get these right now.”

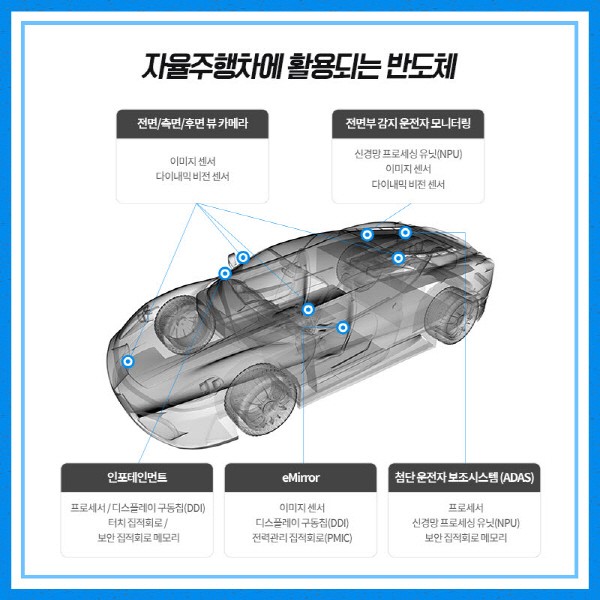

The recent surge for next-generation automobile semiconductors is also a big cause for the burden. The number of semiconductors equipped will rise for EVs and autonomous vehicles in comparison to existing internal combustion (IC) engine vehicles. In contrast to IC engine vehicles which use 200 semiconductors, advanced driver assistance systems (ADAS), neural processing units, (NPU), and autonomous vehicles require over 2,000 semiconductors in total. Pat Gelsinger, the CEO of Intel, predicted that, “The market for automobile semiconductors will double by 2030 to reach 115 billion USD (162 trillion KRW), and the number of semiconductors equipped on premium cars will increase by 5 times.”

Semiconductor foundries in Korea and overseas are quickly responding to the demand in semiconductors for automobiles. Samsung Electronics has set goals to reach number 1 in the market for automobile memory by 2025 as automobile semiconductors join mobiles and servers as one of the three major rapidly emerging applications. In addition to the listing of Mobileye, the autonomous driving semiconductor, Intel is responding to the automobile semiconductor market in all directions. TSMC is also collaborating with global finished automobile companies to speed up production of semiconductors for vehicles. Most of them are a part of the cutting-edge semiconductor market under 4~5 nanos.

In addition to automobile semiconductors, the instability in the supply and demand photomask could set off a domino effect of negative consequences in the production of other system semiconductors, such as mobile AP, graphics cards, central processing units (CPU), and graphics processing units (GPU) as well. A member of the industry said that, “Due to the demand of high-performance semiconductors, there is a trend of huge increases in the number of photomasks used in each process,” and emphasized that, “There is a need to thoroughly check the overall supply and demand and continuously monitor supply measures.”

By Staff Reporter Jiwoong Kim (jw0316@etnews.com)