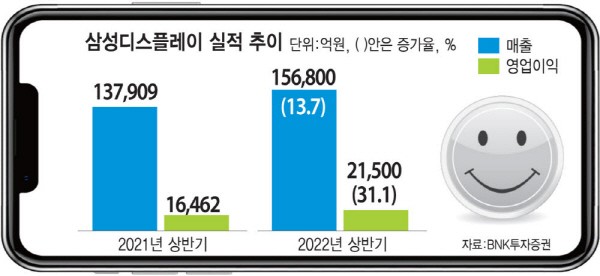

KRW 15.6 trillion in sales and KRW 2.1 trillion in operating profit in the first half

Record-high earnings expected this year

Samsung Display supplies most of LTPO OLED panels for 'iPhone 14 Pro'

A

Samsung Display is expected to have a record-high performance this year despite the downturn in the information technology (IT) downstream industry. A large portion of this was due to Apple's 'iPhone effect’. The performance ‘satisfaction’ with domestic and foreign competitors is under the spotlight.

The industry predicts that Samsung Display will generate record-high sales and operating profit this year. Its earnings consensus cannot be confirmed since Samsung Display is an unlisted subsidiary of Samsung Electronics. The industry predicted that this year's sales and operating profit would greatly exceed last year’s KRW 31.71 trillion and KRW 4.46 trillion, respectively.

Samsung Display posted KRW 15.68 trillion in sales and KRW 2.15 trillion in operating profit in the first half of this year, which is 13.7% and 31.1% increase, respectively, compared to the first half of last year. Samsung Display exhibits a ‘lower first half and higher second half' performance trend, with its highest earning during thefourth quarter.

The iPhone drove the increase in earnings. Samsung Display's main customers are Samsung Electronics and Apple. The demand for iPhone was relatively high despite the stagnant growth of the global smartphone market. Although Samsung Electronics' smartphone sales decreased, sales of foldable smartphones increased significantly, and its 1.5 times the price of existing panels contributed to earnings growth.

The popularity of Apple's iPhone 14 Pro series was considered to be a key factor in improving earnings. The Pro series refers to the top two iPhone 14 models. The Pro model is equipped with a low-temperature polycrystalline oxide (LTPO) OLED panel, which is a high-value product. Samsung Display supplied most of Apple's iPhone 14 Pro series panels this year.

Samsung Display has secured a technology that is significantly ahead of its competitors when it comes to LTPO-type OLED panels. It has been more than two years since LTPO OLED technology mass-production has stabilized. Samsung Display supplied all of LTPO OLEDs in the iPhone 13 Pro.

An industry official said, “The iPhone 14 sales reported stagnant in the Chinese market; however this referred to iPhone 14 general and plus models. This year’s iPhone pro volume increased by nearly 70%, leading to an increase in high-value OLED orders.”

Samsung Display also exhibited the 'reflected profit', which is a supply problem that emerged from latecomers. All of the amount was transferred to Samsung Display that experienced delay in the initial production of LTPO OLED display from a late iPhone panel manufacturers. China's BOE iPhone supply decreased as well due to the design change problem at the beginning of the year.

The increased earning also was influenced by the high exchange rate. Samsung Display benefited significantly from overseas sales since the exchange rate surpassed the KRW 1,400 for the first time in 13 years. The rapid liquid crystal display (LCD) business liquidation helped to reduce the deficit.

It is unsure whether the increased earnings will continue into next year. If thestagnant iPhone sales continue to arise and a latecomer gets approval for mass production of LTPO, Samsung Display's shipments may decrease to some point. The consumer sentiment may also shrink if inflation hits major markets and geopolitical uncertainty persists.

By Staff Reporter Sora Park (srpark@etnews.com)