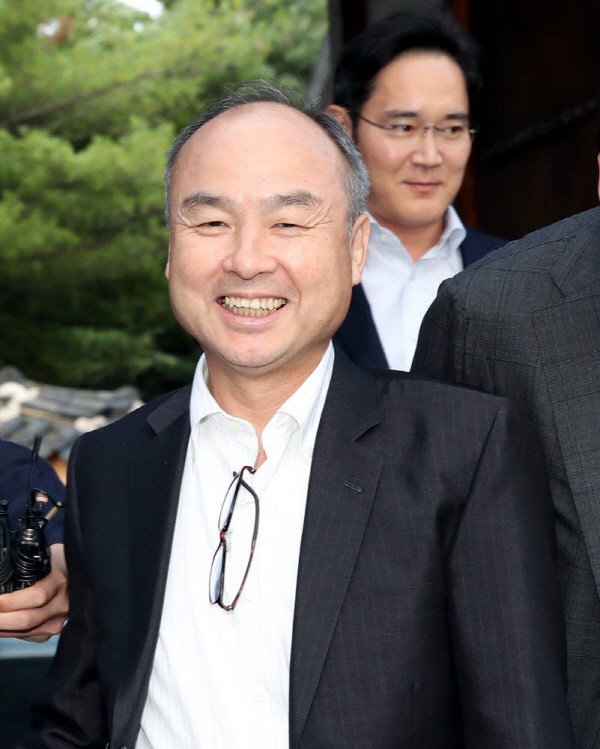

As Jeong-ui Son, Chairman of SoftBank, officially formalized his visit to Korea next month, discussions on the sale of ARM, the world's largest semiconductor design asset (IP) company owned by SoftBank, are expected to speed up. As Chairman Son is scheduled to meet with Jae-yong Lee, Vice Chairman of Samsung Electronics, it is highly likely that Samsung Electronics will participate in the acquisition of ARM. There are many challenges to be solved, such as the sale price and regulatory approval from governments of mergers and acquisitions (M&A).

According to Bloomberg, Chairman Son will visit Korea next month to have strategic discussions with Samsung Electronics regarding ARM. Vice Chairman Lee also told reporters from an overseas business trip on the 21st, "If Chairman Son comes to Seoul next month, he would make such a proposal (ARM-related)." In fact, it seems that Chairman Son will ask Samsung Electronics to participate in the acquisition of ARM.

ARM has been consistently brought up as a candidate for Samsung Electronics' M&A. ARM has a strong market influence, accounting for 90% of the mobile semiconductor IP market. If Samsung Electronics acquires ARM, they can strengthen their mobile capabilities such as Exynos. Samsung Electronics, which already has deposit of more than 100 trillion KRW, has predicted that they will secure a new growth engine through M&A. At the beginning of this year, Vice Chairman of Samsung Electronics, Jong-hee Han, said, “We are considering M&As in various business areas. We are expecting some good results very soon.”

Even if Samsung Electronics participates in the acquisition of ARM, it seems difficult to take over on their own. This is because it is difficult to obtain approval from national regulatory authorities. It is the same background that Nvidia tried to acquire ARM for 66 billion USD but failed. At that time, regulatory authorities such as the US, UK, and the European Union (EU) all expressed opposition. Samsung Electronics, Intel, AMD, and Qualcomm were also concerned that the possession of ARM by a specific company could cause a setback in the stable supply of mobile semiconductor IP.

In the end, the consortium form can be only an alternative. In addition to Samsung Electronics, Intel, SK hynix, and Qualcomm are also known to be considering the acquisition of ARM. If the acquisition of ARM is made in the form of a consortium, competition for stake acquisition is expected to follow.

The price is a problem. Recently, the industry estimates the maximum value of ARM to be around 100 trillion KRW, and puts the estimated value around 50 to 70 trillion KRW. It is expected that proposal of Nvidia, 66 billion USD, will be used as an indicator of the sale price. Considering that SoftBank acquired them in 2016 with 23.4 billion GBP (about 37 trillion KRW), it is a profitable business. However, the sale price may fluctuate as SoftBank's circumstances are not favorable. SoftBank posted a net loss of 3.16 trillion JPY (about 31.3 trillion KRW) in the second quarter, falling into a loss for the second quarter in a row. They are considering the sale of various assets in order to secure funds even at the risk of investment losses. As ARM's sale of Nvidia failed, it cannot be ruled out that SoftBank, which is in an urgent financial situation, may offer ARM at a lower price.

The acquisition consortium is likely to offer a lower price, as there have been cases of paying the M&A failure penalty if regulatory authorities fail to obtain approval for the acquisition.

◇ARM=Provides semiconductor intellectual property (IP) to semiconductor development companies and makes profits by receiving licenses or royalties. Many semiconductor companies such as Samsung Electronics, Apple, Qualcomm, Nvidia, and Intel are using ARM-based IP. SoftBank holds a 75% stake, and the rest of 25% is owned by SoftBank's Vision Fund.

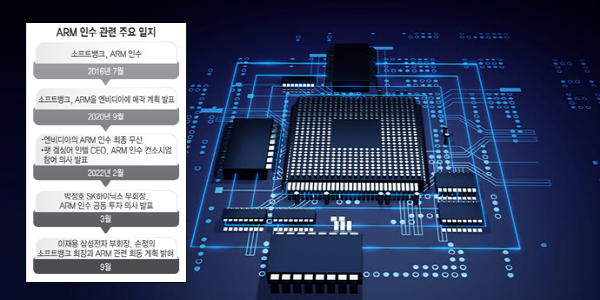

[Key Summary of the ARM Acquisition]

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)