Servers have rapidly emerged as the core demand for DRAM memory. The center of gravity shifted toward servers with relatively high demand as the proportion of DRAM installed in smartphones and PCs gradually decreased due to the downturn of global economy. The server market continues to invest in data centers in preparation for a decline in smartphone shipments and slowing PC market growth, and has established itself as the largest DRAM memory market.

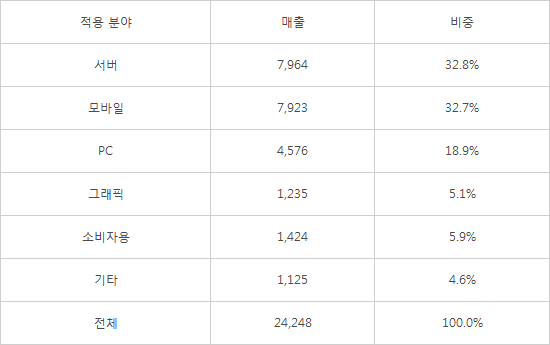

The servers surpassed mobile for the third consecutive quarter in terms of sales by DRAM application field until the first quarter according to Gartner. The server-related DRAM sales accounted for 32.8% of the total, slightly surpassing 32.7% of the mobile-related DRAM sales as of the first quarter. The server-related DRAM surpassed that of mobile for the first time since the last third quarter, and maintains the top in sales.

After server and mobile sales, the application field with the highest proportion was PC, which accounts for 18.9% in the first quarter. However, PC-related DRAM sales has continued to decline since the last second quarter. PC-related DRAM sales also fell for the three quarters in a row.

The increase in the portion of server-related DRAM is largely attributable to a decrease in smartphone and PC sales. It is understood that consumer purchasing sentiment has contracted due to the downturn of global economy, increased raw material prices, and inflation. Manufacturers are adjusting their shipments as the replacement cycle duration for consumer products in smartphones and PCs is lasting longer. The industry anticipates that this year’s smartphone shipments will decrease by 10% compared to the previous year. The decline in smartphone and PC shipments caused slump in the mobile and PC-related DRAM market.

On the other hand, server-related DRAM is maintaining steady sales without a major drop. Although there are concerns that investment in information technology (IT) infrastructure will slow amid the economic downturn, data throughput continues to increase, and is driving demand for DRAM. Cloud sales of big tech companies, such as Amazon Web Services (AWS), Microsoft (MS), and Google, grew by 30% in the second quarter, which indicates the continuous growth in the server market such as data centers.

The increase in the portion of server-related DRAM sales is expected to continue in the second and third quarters. The overall shipment volume was affected by the shortage of major server parts until the first quarter. However, the supply chain crisis is partially resolved and server shipments are expected to stabilize in the second quarter. TrendForce predicted that server shipments in the second quarter would increase by 15.6% compared to the previous quarter. The third quarter shipment is expected to be grow by 6.5%. In contrast, the possibility that the proportion of DRAM sales for mobile and PC will decrease even further cannot be ruled out as the second and third quarters in the low season for traditional smartphones and PC markets.

An industry official said, “The change in the proportion of sales by manufacturer’s product (application) follows a similar trend as domestic DRAM manufacturers such as Samsung Electronics and SK Hynix have the largest global market share. The servers have become the core demand source as the proportion of sales the server-related DRAM increases.”

[Sales and proportion of DRAM application fields in the first quarter of 2022]

(Unit: $1 million)

Provided by Gartner

By Staff Reporter Dongjoon Kwon (djkwon@etnews.com)