Last year’s sales, up 57% from the previous year

One step up in the global rankings

Starting with expanding Samsung Electronics’ facility investment

Due to increase in the proportion of etching proc

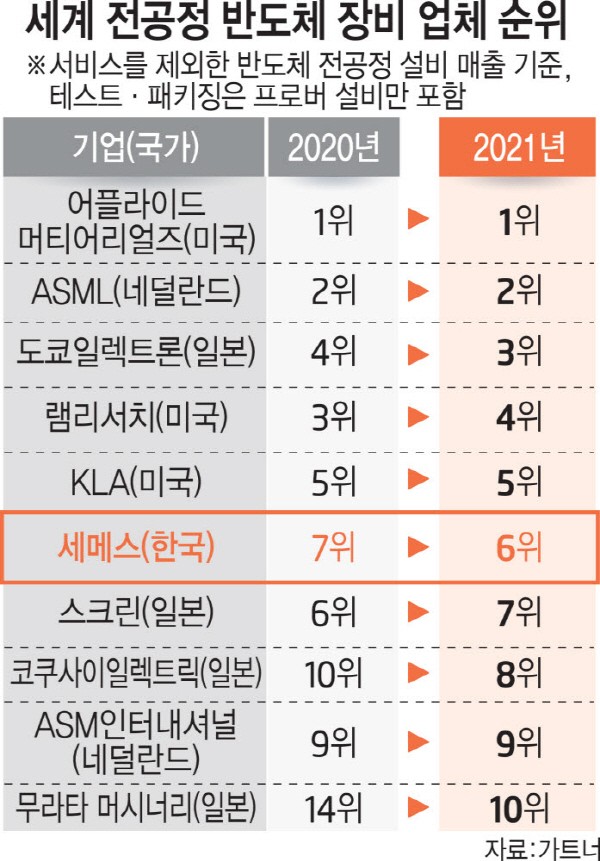

SEMES rose a notch in sales ranking in the semiconductor front-end process equipment sector, rising to the 6th place in the world. This is being seen as a result of the combination of the increased investment in facilities by Samsung Electronics, a major customer, and the increase in the proportion of advanced process equipment such as etching. SEMES is strengthening its market influence by diversifying its product portfolio, such as semiconductor wafer transfer equipment (OHT) and cleanroom facilities.

According to Gartner's latest ranking, SEMES' sales of front-end equipment was $2.2 billion last year, up 57% from the previous year. It surpassed SCREEN, a leading Japanese semiconductor cleaning equipment company, and ranked sixth in the world. It was just behind the top five global companies, including Applied Materials, ASML, Tokyo Electron (TEL), Lam Research, and KLA.

Gartner's ranking excludes all packaging and testing equipment except for probers, which inspect whether wafer chips are working properly. Service sales for front-end equipment such as maintenance and parts management were also excluded. Thus it can be used as an index to solely measure the competitiveness of front-end equipment. SEMES is focusing on cleaning, coating/developing, and etching equipment in the semiconductor front-end process.

SEMES rise in ranking is being seen as the result of Samsung Electronics' rapid increase in facility investment last year and securing a competitive edge in the front-end process. Samsung Electronics introduced large-scale equipment to establish its Pyeongtaek 2·3 semiconductor factory (P2·P3). It appears that many SEMES equipment have been adopted in line with the localization trend of semiconductor equipment.

The expansion of the competitiveness of SEMES' front-end process equipment also played a role. In particular, SEMES is known to have stood out in the fiercely competitive etching process equipment. SEMES' production of etching equipment last year increased by about 34% compared to the previous year, with a total of 143 units. Production capacity is also continuously expanding.

Amid concerns that investments in semiconductors will slow this year, SEMES plans to enter the advanced process field and diversify its portfolio in order to overcome the situation. Samsung Electronics' investments in its P3 facility is continuing, and construction of Samsung Electronics' Taylor Foundry in the US is expected to actively begin in the second half of the year. As a result, the demand for SEMES equipment is likely to increase as well.

SEMES successfully localized OHT equipment, which relies heavily on foreign products such as Japan, and is supplying it to the market. It is also expanding the performance of various cleanroom facilities that are essential for advanced processes. The market for SEMES' advanced process equipment is expected to grow, since Samsung Electronics operates a 3-nanometer ultra-fine process.

The industry predicts that SEMES, which surpassed the 3 trillion won mark for the first time last year, will achieve a similar level of performance this year. SEMES recorded 1.472 trillion won in sales in the first half of the year.

By staff reporter Dong-joon Kwon (djkwon@etnews.com)