LG Chem up 163% from last year

EcoProBM surpass 100 billion won

Uptrend expected to continue in the second half of the year

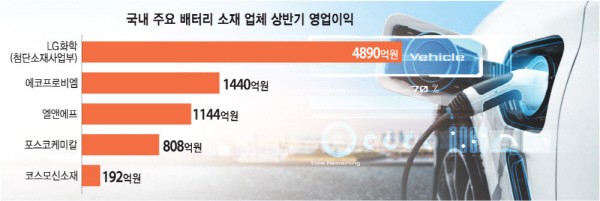

Major domestic battery materials companies managed to reach a record high 900 billion won in operating profits in the first half of this year. The expansion of high value-added cathode materials in the electric vehicle battery market by battery material companies such as LG Chem, EcoProBM, L&F, POSCO Chemical, and Cosmo Advanced Materials, led to the growth in earnings. The strengthening response to changes in international raw material prices was also cited as a factor in the increase in profits.

LG Chem recorded 489 billion won in operating profit from its advanced materials business in the first half of this year. Operating profit soared 163% compared to the same period last year. LG Chem's advanced materials division is involved in battery materials, semiconductor materials, and engineering materials, and its battery materials, including cathode materials, accounted for more than half of the total.

EcoProBM, L&F, POSCO Chemical, and Cosmo Advanced Materials recorded 358.4 billion won in profits in the first half of the year as their supply of cathode materials for EV batteries increased. Combined with LG Chem, operating profit in the first half was 847.4 billion won.

EcoProBM's operating profit was 144 billion won, the highest among cathode material producers. Their operating profit in the first half was 29.6 billion won higher than L&F (114.4 billion won), the second-largest cathode material producer. EcoProBM surpassed 100 billion won in quarterly operating profit for the first time in its history. POSCO Chemical and Cosmo Advanced Materials also achieved record-high profits in the first half of the year. The record-breaking performance is attributed to the boom in the EV battery market, the expansion of supply of high-value-added high-nickel cathode materials, as well as factors such as a rise in the exchange rate.

The strengthening cooperation in key mineral supply chains between domestic battery manufacturers such as LG Energy Solution, Samsung SDI, and SK On also led to the increase in profits. According to analysts, they managed to reduce the cost of raw materials by securing raw materials such as lithium, nickel, cobalt, and manganese in advance. An official from the material industry said, "Battery manufacturers are increasing their purchasing power for key minerals by securing large quantities of products with unstable supply and demand at low prices."

Earnings in the battery materials industry are expected to keep rising in the second half of the year. The boom in the material business for EV batteries is expected to continue. EcoProBM increased the proportion of nickel, cobalt and manganese (NCM) battery products for EV batteries from 27% to 30%. However, some point out that it is necessary to develop high-value high-nickel products and strengthen product price competitiveness compared to Chinese material companies. In particular, battery manufacturers need to strengthen their competitiveness by developing new products since they use a high proportion of Chinese materials.

< Table> Operating profit of major domestic battery material companies in the first half of the year

By staff reporter Ji-woong Kim (jw0316@etnews.com)