Ministerial Semiconductor Special Committee proposed the bill on the 4th

Large enterprises, facility investment ‘3 times benefit’

Bill extended until 2030

Ease of licensing for forming specialized c

The 'Korean Chips' act to supports large-scale tax deduction on investment in semiconductor facilities was introduced. Large corporations can receive three times more than the current tax deduction on their facility investment.

By expanding the scope of tax deduction to the human resources for semiconductors, the chronic labor shortage is also expected to be resolved. The licensing procedure for the forming of semiconductor-specialized complexes will also be shortened.

The ‘Semiconductor Industry Competitiveness Reinforcement Special Committee (Semiconductor Special Committee)’ of the People Power Party unveiled the ‘Semiconductor Industry Competitiveness Enhancement Act (Bill)’ on the 2nd. The bill is a package bill including amendments on the ‘National Advanced Strategic Industry Special Act’ (Semiconductor Special Act) and the ‘Special Taxation 'Restriction Act’ (Tax Special Act).

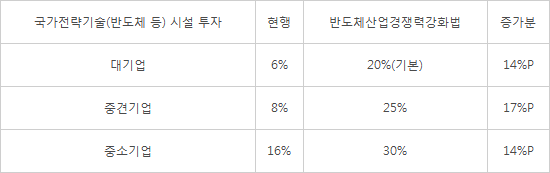

The main point of new bill is the expansion of tax credit. By amending the Special Act, they tax credit period will be extended from 2027 to 2030 by three years for investments in national high-tech strategic industrial facilities such as semiconductors. This is three years longer than the current period which is until 2027. The facility investment tax deduction rates were also significantly being increased to 20% for large enterprises, 25% for medium-sized enterprises, 30% for small and medium-sized enterprises, and 5% for excess. According to the current Special Act, rates for semiconductor (National Strategic Technology) facility investment is 6% for large enterprises, 8% for medium-sized enterprises, and 16% for small and medium-sized enterprises. There was a bill specifying a 20-30% tax credit to attract investment in semiconductor facilities. This bill holds significant meaning as it was introduced by the Semiconductor Special Committee.

By expanding the scope of tax deduction, it will also support research and development (R&D) and human resource training. Professor Deog-Kyoon Jeong of Seoul National University, who is a member of the Special Committee, said, “The operating expenses of contract departments for nurturing customized human resources have been included in tax deduction for research and human resources development expenses. They also extended the tax reduction period of excellent foreign technicians working in high-tech strategic industries from 5 years to 10 years.” Aside from that. if a company donates assets such as semiconductor equipment to universities, the corporate tax amount equivalent to 10% of the market price will also be deducted.

They also strengthened 'manpower training', which was pointed out as a limitation of the existing Semiconductor Special Act. In order to supply semiconductor manpower smoothly, tailored high school programs for industrial needs will be added and the number of students will be increased. In the case of hiring public workers for the purpose of nurturing and re-educating semiconductor specialists, the qualification criteria will be eased and concurrent positions will be possible. This will be a stepping stone to solve the problem of a shortage of professors that emerged along with the discussion on the expansion of the semiconductor department. In order to quickly create and designate a semiconductor-specialized complex, the duration of the licensing process will be reduced from 30 days to 15 days. The scope of the preliminary feasibility study exemption will also be expanded to public corporations or public institutions.

The Semiconductor Special Committee will submit the Semiconductor Industry Competitiveness Enhancement Act (Bill) on the 4th. This is the enforcement day of the Semiconductors Special Act. The response of the Ministry of Economy and Finance is gaining attention as the tax support for semiconductor facility investment has increased. The Ministry of Economy and Finance is known to be understanding of the need for a tax credit for high-tech industries such as semiconductors. However, concerns about the difficulty of raising tax revenue were also raised.

Rep. Hyang-ja Yang (Chairman of the Semiconductor Special Committee) said, “It is important to quickly create a retroactive structure (for facility investment) and a virtuous cycle of reinvestment. The contents of the bill will be discussed in detail when the bill is reviewed by the Ministry of Economy and Finance along with the opinions of members of the Special Committee and ministries after finally seeing the total financial resources.”

[Changed rates of tax deduction for facility investment according to ‘National Strategic Technology’ of Semiconductor Industry Competitiveness Enhancement Act (Bill)]

By Staff Reporters Dong-jun Kwon (djkwon@etnews.com), Ki-chang Choi (mobydic@etnews.com)