To expand tax credit for large corporations by 20%

Respond before attracting semiconductor production bases

Activate operation of corporate semiconductor contract department

Expected to accelerate the

The 'Semiconductor Industry Competitiveness Reinforcement Act' issued by the People Power Party's Special Committee for Reinforcing the Competitiveness of the Semiconductor Industry (Semiconductor Special Committee) is a special measure to accelerate domestic investment for semiconductor companies. This is because the legal basis to attract private investment was weak under the existing semiconductor special law. In contrast, the US, Europe, Japan and China are trying to attract semiconductor production bases in their countries with large-scale tax benefits. The special committee will strengthen the competitiveness of the semiconductor industry, which has emerged as a national strategic weapon, by matching the tax support benefits of competing countries.

The U.S. House of Representatives passed the “Chips-Plus Bill” on the 28th (local time) of last month which includes a total of $52 billion in funding. The bill takes effect immediately when signed by US President Joe Biden. U.S. semiconductor law provides a 25% tax credit for investments in U.S. semiconductor facilities.

It is a strategic move for the US, which lacks semiconductor production capacity compared to Korea and Taiwan, to revitalize domestic corporate investment and attract foreign companies. Europe and Japan are also increasing their semiconductor production bases with huge tax support. The Japanese government has reportedly provided 40% of the investment cost for Taiwan's TSMC factory in Kumamoto Prefecture and the German government has provided the same for Intel's Magdeburg factory.

Amid the fierce competition to attract semiconductor production bases, Korea was criticized for not having enough 'carrots' to attract corporate investment. This is because the tax deduction rate was less than half compared to its competitors. Rising raw material prices and delays in delivery of major facilities are increasing the burden on corporate investment. This is why the Semiconductors Special Committee has increased the facility investment tax credit to 20% under the Special Tax Restriction Act (Special Tax Act), which was only 6% for large corporations. SMEs are also expected to be provided up to 30% (currently 16%) tax benefits to strengthen the infrastructure for manufacturing materials, parts and equipment (MPE) surrounding the semiconductor industry.

Some solutions have also been found for training human resources, which has been pointed out as a blind spot in the existing 'National Advanced Strategic Industry Special Act (Semiconductor Special Act)'. High schools tailored to the needs of the semiconductor industry were included in the talent training project. It is expected to contribute to securing field-type workers, a prerequisite for creating a nationwide semiconductor cluster.

It is also expected to accelerate high-quality human resource training at the master's and doctorate-level, which the semiconductor industry continuously requires. The amendment to the Special Tax Act mentions that 'the operating expenses of a company's semiconductor contract departments is subject to tax deductions asa research and human resource development expense'. Semiconductor companies such as Samsung Electronics and SK Hynix can significantly reduce the burden of operating semiconductor contract departments. It can also contribute to revitalizing semiconductor contract departments that nurture high-quality human resources. MPE companies, that had difficulties operating semiconductor contract departments due to costs and other issues, are also expected to participate.

The National Assembly's role has become more important to pass the bill. Since the bill was introduced by the ruling party's Semiconductor Special Committee, they still need to convince the opposition party to agree. The Semiconductor Special Act, which is about to go into effect, took eight months to pass due to differences in opinion between the ruling and opposition parties and conflicts between ministries. This is weak point considering the semiconductor industry requires fast technological change and rapid investment.

Rep. Hyang-ja Yang (Chairman of the Semiconductor Special Committee) said, “I ask that lawmakers from the opposition party actively participate in the joint initiative of the bill so that the controversial bill can quickly pass through the National Assembly, and the semiconductor industry can pursue a future with continuous support," and emphasized that, “Cooperation between the ruling party, opposition party, government, industry, and academia concerning semiconductors must continue." The Semiconductor Special Committee also requested a permanent special committee at the National Assembly level and the implementation of a pan-ministerial control tower for the semiconductor industry.

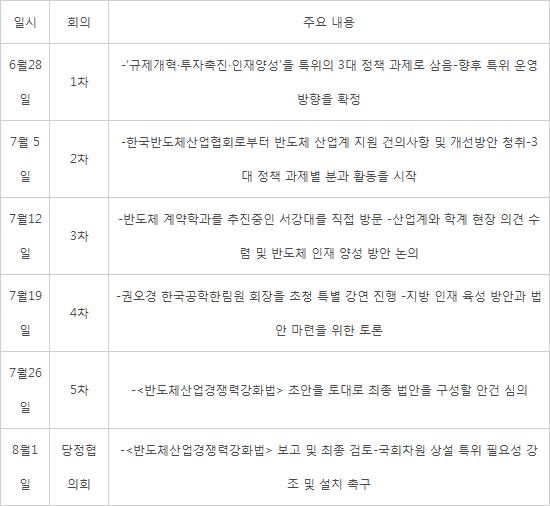

[Main Activity Log of the People Power Party's Special Committee for Reinforcing the Competitiveness of the Semiconductor Industry (Semiconductor Special Committee)]

By staff reporter Dong-joon Kwon (djkwon@etnews.com), Reporter Ki-chang Choi (mobydic@etnews.com)