The capacity utilization rate for consignment production of 8-inch wafer-based products, a major item in supply shortage in the semiconductor industry, is analyzed to be declining. The decline can be interpreted as the effect of semiconductor fabless reducing orders due to a decrease in demand for home appliances such as smartphones and TVs. As the foundry bottleneck is resolved, the semiconductor supply shortage is expected to be partially resolved. On the other hand, there are concerns about a reduced growth rate in the semiconductor market.

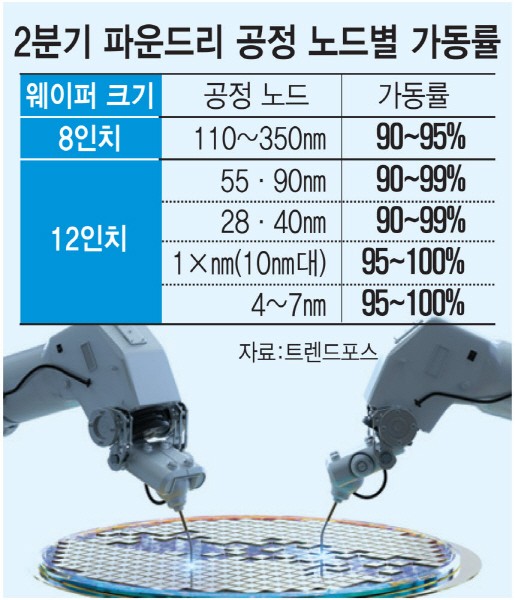

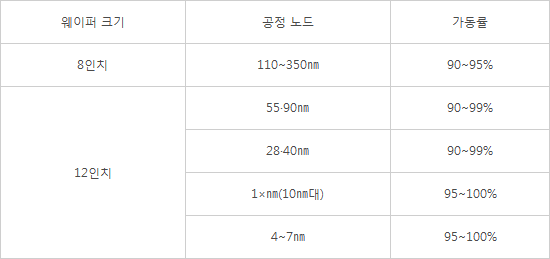

According to TrendForce, a market research firm, the capacity utilization rate of 8-inch foundries decreased to 90% in the second quarter. It mainly produces display driving chips (DDI), image sensors, and power management integrated circuits (PMIC) on a 110-350 nanometer (nm) process. Even at the beginning of this year, the bottleneck was so severe that production orders were practically closed for a year. It is interpreted that the capacity utilization rate has been reduced due to the recent decrease in orders.

The 12-inch foundry capacity utilization rate also faced a slight decline. TrendForce revealed that the 28-90nm mature process capacity utilization rate is 90-99%. It is analyzed that this is due to the decrease in smartphone shipments and the contraction of the TV and PC market. IDC, a market research firm, predicted that smartphone shipments this year would decrease by 3.5% from the previous year to 1.31 billion units. This is the first negative growth in two years. The smartphone industry is reportedly reducing orders for semiconductors and parts due to reduced production. There is a market sentiment of maximizing existing inventories and refraining from requests for new semiconductors and parts production.

Foundry capacity utilization rates are also expected to change in South Korea. A domestic semiconductor fabless representative said, "We plan to rebalance new orders for semiconductors as set shipments such as smartphones are expected to decrease." He announced that “semiconductor sales will decline in the second half of the year than expected earlier this year.”

Foundries generally take orders for mass production every six months. In January, domestic foundries were in a 'full-booking' situation with all orders for six months. According to the demand survey at the time, it was found that all orders for the six months in the second half were received. However, it is highly likely that the order volume received earlier will be adjusted due to the economic downturn in the second half. Although the foundry bottleneck, which was the main cause of the semiconductor supply shortage, may be partially resolved, there may be signs of a contraction in the semiconductor market.

However, the industry consensus is that demand for automotive semiconductor products such as micro controller units (MCUs) still stands solid. Additionally, advanced semiconductors under 10-nm process are still in demand. This is because the data center market demand such as high-performance computing (HPC) is continuing with the capacity utilization rate of 95-100%.

[Quarter 2 foundry process node capacity utilization rate]

Source: TrendForce

By Staff Reporter Dong-jun Kwon djkwon@etnews.com