The global share of the Chinese semiconductor foundry market has exceeded 10% for the first time. It made a leap forward focusing on the mature process where the supply shortage of semiconductors is increasing. The growth of Chinese foundry companies, which made large-scale facility investments last year, is expected to continue.

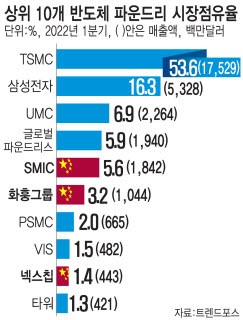

According to market research firm TrendForce, Chinese foundry companies SMIC, Huahong Group, and Nexchip recorded a total of $3.329 billion in sales in the first quarter of this year. These three companies are China's leading foundries, with a combined market share of 10.2%. Although the combined market share increased slightly from 9.3 percent in the previous quarter, it was the first time it surpassed 10%. Compared to the fourth quarter of last year, SMIC increased by 0.4%, Huahong Group by 0.3%, and Nexchip by 0.2%, respectively.

The rise of Nexchip was remarkable. Nexchip, which mainly produces large display drive chips (DDI), surpassed DB HiTek in the fourth quarter of last year and entered the top 10 in sales. It even surpassed Tower, which was acquired by Intel in the first quarter, ranking in the 9th position.

The growth of Chinese foundries was mainly driven by the expansion of production capacity following large-scale facility investment. SMIC made a facility investment of about KRW 2.6 trillion in the fourth quarter of last year. This is an increase of 97% compared to the previous quarter. In the fourth quarter of this year, Huahong Group also made investments, which increased by 51% compared to the previous quarter. Nexchip is also aiming to expand its production capacity by building an N2 plant this year. It will also diversify its products such as image sensors, microcontroller units (MCUs), and power management integrated circuits (PMICs).

The industry evaluated that China, where it is difficult to switch to a high-tech process, is rapidly increasing its production capacity with a mature production process at the forefront. An official from the semiconductor industry stated on the 21st, "China, where it is difficult to introduce advanced process equipment due to the U.S. containment, is expanding its market influence toward the mature production process." Some domestic fabless, which could not secure mass production lines due to foundry bottlenecks, are also considering consigning production to Chinese foundries.

As Chinese foundries and semiconductor manufacturers secure a large number of process equipment, the expansion of production capacity is expected to continue.

The Semiconductor Equipment and Materials International (SEMI) predicted that China's semiconductor equipment purchases will reach $17.5 billion this year. Although it decreased slightly compared to last year, it is the third-largest in the world after Taiwan and South Korea. China became the world's largest buyer of semiconductor equipment in 2011 and 2010.

Meanwhile, TSMC, the world's No. 1 foundry company, had a market share of 53.6% in the first quarter of this year. Samsung Electronics recorded 16.3%, a slight decrease from the previous quarter. TrendForce analyzed that Samsung Electronics' market share decreased due to the recession in the TV and smartphone markets.

By Staff Reporter Dong-jun Kwon djkwon@etnews.com