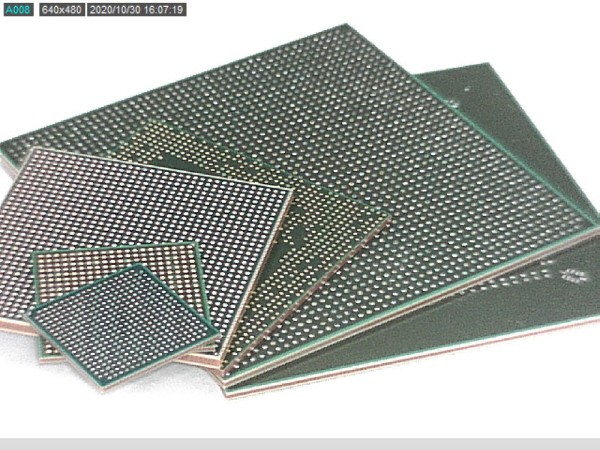

The semiconductor package substrate (PCB) industry is expected to achieve record-breaking highs this year. Some companies are expected to record their highest double-digit operating profits. It is predicted to maintain its boom for the second year in a row, following last year.

The domestic PCB industry, which has expanded its investments mainly on high value-added boards, is expected to record its highest earnings this year. It has benefited from the global demand surge for semiconductor package substrates.

Daeduck Electronics recorded KRW 305.4 billion in sales and KRW 44.8 billion in operating profit in the first quarter, far surpassing market expectations. Operating profit in the first quarter soared 567% compared to the same period last year. The industry predicts that the second quarter will also grow compared to last year.

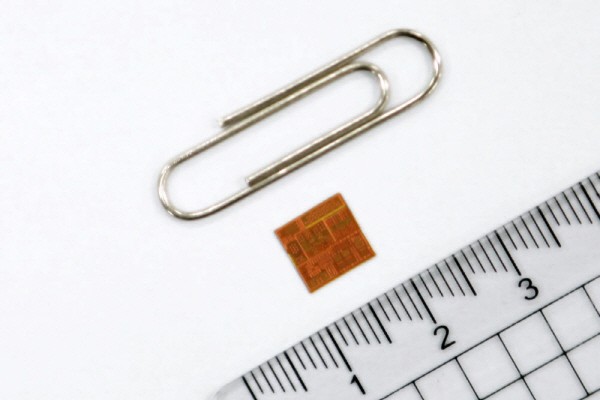

Daeduck Electronics recorded good earnings as its Flip Chip-Ball Grid Array (FC-BGA) substrate business, which is being fostered as a new growth business, made genuine profits. Daeduck Electronics' profit margin also improved significantly as it reorganized its business to focus on high-value-added substrates. The operating profit margin, which recorded 7.2% last year, is expected to surpass 10% this year.

Korea Circuit recorded KRW 410.8 billion in sales and KRW 31.1 billion in operating profit in the first quarter. Sales increased by 38% and operating profit by 303%, compared to the same period last year. The operating profit margin is 7.5%. Sales increased mainly from high value-added products, which resulted in good earnings. It is expected to record KRW 1.6 trillion in annual performance and KRW 150 billion in operating profit this year.

Simmtech recorded KRW 417.6 billion in sales and KRW 83.9 billion in operating profit in the first quarter. Unlike its competitors, Simmtech did not enter the FC-BGA substrate business, but diversified its portfolio to focus on high value-added products, resulting in an operating profit margin of nearly 20%. Sales are also expected to the highest among mid-sized PCB makers.

Samsung Electro-Mechanics and LG Innotek's semiconductor substrate businesses, which are affiliates of larger companies, are also cruising. The two companies' semiconductor package businesses are expected to record all-time highs this year.

The package solution sector, which is in charge of Samsung Electro-Mechanics' semiconductor substrate business, managed to reach nearly 20% in sales proportion in the first quarter. Samsung Electro-Mechanics is strengthening its competitiveness by investing in FC-BGA facilities. The package substrate sector's operation rate is currently over 90%, and it is expanding its application fields and expanding its market share.

LG Innotek is also focusing on the semiconductor package substrate business, which has a higher operating profit margin than its smartphone camera module business.

It has formally entered into the FC-BGA business and is expanding its investments in facilities. LG Innotek also ranks first in the world in RF-SiP and AiP substrates, which are components for communication semiconductors, and tape substrates and photomasks, which are components for displays. LG Innotek is believed to have record the highest profitability ever by expanding its business to high value-added products in the substrate business.

By Staff Reporter So-ra Park srpark@etnews.com