Automobile industry prefers lithium iron phosphate

Energy density decreases by 20%

Competitive price and less ups and downs

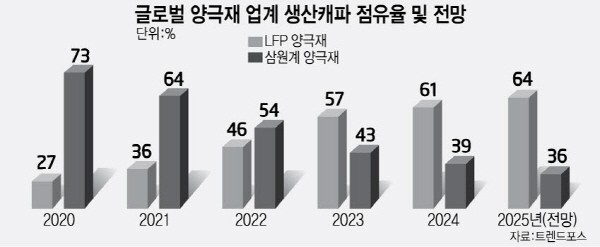

60% of the total market expected in 2024

In the next two years, it is predicted that the market share of ternary lithium-ion batteries, led by South Korea and Japan, in the global battery market will be overtaken by lithium iron phosphate (LFP) batteries, led by China. The primary reason is because global automakers prefer cheap lithium iron phosphates due to the rising price of minerals such as lithium, nickel, and cobalt.

In its latest report, TrendForce, a market research firm, predicted that Chinese-led LFP batteries will overtake lithium-ion ternary (NCM, NCA, NCMA) batteries and account for 60% of the total market in 2024, due to the rising raw material prices for batteries. As of 2021, the global market share of ternary batteries is more than 60%, which is higher than LFP batteries, which hovers around 32~36%.

However, it has been analyzed that LFP anode materials account for 64% of the 11 million tons of cathode materials, which is awaiting expansion by the global cathode material industry. In addition, since the energy density has improved by over 80% compared to the ternary system, due to the recent increase in raw material prices and the advancement of LFP design technology, it is predicted that the preference for LFPs in the automobile industry will increase soon. Although the energy density of LFP cathode materials is lower by 20%, the price competitiveness is higher than 30%. Its strength is that price fluctuations are not as severe as those of raw materials for ternary.

TrendForce announced that among the Chinese EV batteries last year, LFP batteries overtook the market share of ternary batteries, and the LFP market share rose to 58% in the first quarter of this year. Analysts foresee the market share of LFP batteries continuing to rise.

According to TrendForce, as the price of raw materials for core batteries has risen significantly since the second half of 2021, the auto industry is focusing on reducing battery material costs and securing stable supply chains.

According to the London Metal Exchange (LME), cobalt, a key raw material for cathode materials, surpassed the $81,000 mark on the 11th of this month, from $42,000 per ton in October last year. Nickel did not exceed $20,000 per ton until the first half of last year, but after that it surged to $33,000 on the 11th. In a situation where supply and demand effects due to 'COVID-19' continued, the price of cobalt rose by 12% and nickel by 26% in just over a month due to Russia's invasion of Ukraine.

If raw material prices rise, product prices will also rise. Tesla, the world's leading producer of electric vehicles, has already raised electric vehicle prices one after another with regards to the sharp rise in raw material prices. Tesla CEO Elon Musk recently tweeted, “Lithium prices have reached crazy levels and if lithium prices don’t improve, Tesla may have to dive into actual mining and smelting," adding, "Lithium itself exists all over the planet, so there is no shortage, but extraction and purification are slow."

Toyota of Japan also said that the recent rise in prices of cobalt and lithium will raise vehicle prices, and it is inevitable.

In response to the rise in raw material prices, many global electric vehicle brands such as BYD, NIO and Volkswagen in China other than Tesla raised their electric vehicle (EV) sales prices one after another in the first quarter of this year.

By Staff Reporter Tae-jun Park gaius@etnews.com