Amid explosive growth in demand for non-face-to-face and large-capacity data

IT companies focusing investments into high-performance computing infrastructure

Samsung server-oriented DRAM sales surpass

Samsung Electronics and TSMC's data center-oriented semiconductor sales have grown rapidly, emerging as a new growth engine. This is due to global information technology (IT) companies investing heavily into high-performance computing (HPC) infrastructure, resulting in growing demand for memory and system semiconductors in servers. The spotlight on smartphones sales, which has slowed in growth, is shifting towards data centers.

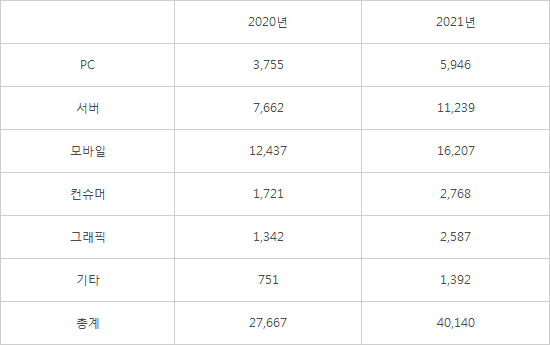

According to Omdia, it is estimated that last year's sales of Samsung Electronics' DRAMs reached $11.239 billion. It is the first time since 2018, when the semiconductor industry was in its early days, that server-oriented DRAM sales exceeded $10 billion. It recorded a high growth rate of 44.6% compared to the previous year, significantly exceeding the growth rate of smartphone DRAMs by 30%.

Samsung Electronics' largest DRAM sales were from mobile. However, as the years go by, that proportion has been decreasing. Mobile accounted for 40.4% of Samsung Electronics' total DRAM sales last year. Its status, which accounted for 45% in 2020, appeared to be waning. The gap with server orientation, which accounts for the second largest proportion, has narrowed from 17.3% point (p) to 12.4%(p).

Data centers have even designated foundries, which have contributed to the growth of system semiconductors, as a 'future food source'. This is because the proportion of HPC sales applied to data centers is gradually increasing. TSMC recently announced at their Q1 earnings conference that the proportion of HPC sales (41%) exceeded that of smartphones (40%). This is also the first time in about 4 years since the second quarter of 2018.

This change is due to the conflicting growths of the smartphone and data center markets. Smartphone sales did not meet expectations after the COVID-19 pandemic. According Counterpoint Research, a market research firm, global smartphone shipments by 2021 reached 1.39 billion units. Although it grew by 4% from the previous year, shipments decreased by about 90 million units compared to pre-COVID-19. This contrasts with data centers that are expected to grow in the mid to late 10% range. Along with the parts shortage, including semiconductors, some believe the smartphone market has entered a phase of slowing growth.

On the other hand, the data center market such as HPC is growing rapidly. This is because demand for non-face-to-face has increased and the amount of large-capacity content data has skyrocketed. As IT companies such as Google, Amazon, and Meta are investing in facilities one after another, the demand for semiconductors for servers is also increasing. In particular, cloud-oriented growth was remarkable. Gartner predicts that the global cloud market will grow to $482 billion next year and nearly double to $837.5 billion by 2025.

Samsung Electronics and TSMC are developing data center-oriented semiconductors as new growth engines. Samsung Electronics recently hired Robert Wisniewski, an HPC expert from IBM and Intel, as its vice president. This is being understood as a stepping stone for strengthening competencies in all areas, including memory and semiconductor design. In addition, the release of a server central processing unit (CPU) that supports DDR5, the next-generation memory standard, is further good news. Demand for DDR5 DRAM, which Samsung Electronics has begun mass producing, is expected to increase in line with the demand for CPU replacement. TSMC is also strengthening its data center-oriented semiconductor business as it battles to secure global CPU customers.

[Sales of Samsung Electronics' DRAM by Demand]

(Unit: Million dollars)

Source = Omdia

By Staff Reporter Dong-jun Kwon djkwon@etnews.com