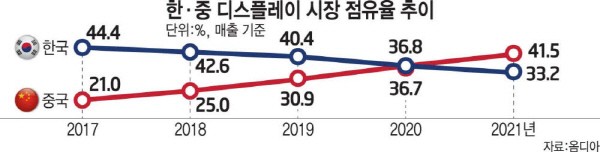

It is the first time that China took over the No. 1 spot in the display market, which Korea has always been a leader in. The title of “the strongest country in display market” is lost after 17 years. It would not be possible to reclaim the No. 1 spot if Korea cannot find a way to expand investment in next-generation displays such as organic light emitting diodes (OLED).

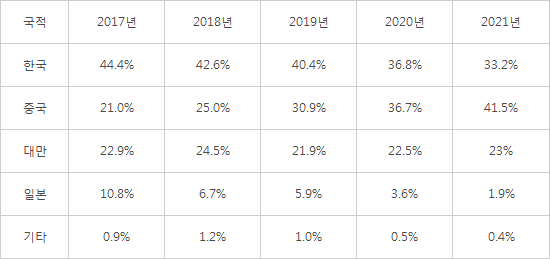

According to market research firm Omdia, China recorded $64.8 billion in sales including LCD and OLED in the global display market last year. China took over Korea’s No. 1 spot with a market share of 41.5%. Korea's market share fell 8.3 points (p) to 33.2%. This is the first time since 2004, in 17 years, that Korea had to hand over the No. 1 spot. Korea had a 9.4 p advantage in market share over China up until 2019.

China overtook Korea and seized power in the LCD market by offering a low-priced products. BOE, China's largest panel manufacturer, has become the world's largest LCD manufacturer with help of the subsidy from the Chinese government. LCD sales was $28.6 billion last year, accounting for 26.3% of the total LCD market. The sales of Chinese companies such as BOE, CSOT, Tianma, and Visionox increased significantly as demand for TV and information technology (IT) devices increased with the prolonged COVID 19 and increased price of LCD panel.

After taken over in the LCD market, Korea is focusing on the highly-valued OLED market. Samsung Display and LG Display are transforming their LCD production lines to OLED. Korea is the No. 1 with 82.3% of the global OLED market shares according to Omdia, and China’s market share only accounts for16.6%.

China's dominance is expected to continue for some time because the large display market such as TVs and laptops still depends on LCD. Only when Korea starts to reduce OLED panel prices by mass producing OLED, then Korea can replace the LCD market led by China.

Samsung Display and LG Display were not able to make a decision on investment plans for large OLED plants due to problems with yield and investment funds. Samsung and LG are expected to invest more than KRW 7 trillion in OLED facilities this year according to the industry. Mass production from these companies is expected to begin in the second half of next year even when new and expanding existing investments are made this year.

China has also started to narrow the gap with Korea in OLED industry. BOE and other companies have commercialized OLED for small and medium-sized displays such as mobile, laptop, and tablet. Following LCD market, China is threatening Korea in OLED market as well as China expands OLED market share mainly in the Chinese smartphone market.

Critics are pointing out that Korea needs to expand in OLED market and develop new technologies in order to maintain the OLED gap with China. Korea must take control over the large TV panel market, which has a large technological gap with China, and create a new form factor with new technologies such as flexible, rollable, and bendable panels.

Some criticizes that R&D support and interest are required even if Korean government does not provide subsidies like the Chinese. It is daunting that the government seems to have lost interest in the display industry by giving support for the government’s national talent developing project, and cutting the support for the next-generation display field.

An official from the display industry said, “With the government-led industrial promotion policy and copious domestic market, China is making an effort to solidify its leading position in the display industry. There is a neglect on display industry in Korea since the display promotion policy is almost non-existent compared to semiconductors and batteries.”

<Table> Display market share by country (based on sales. Provided by Omdia.)

By Staff Reporter Ji-woong Kim (jw0316@etnews.com)