OSAT industry “delivery schedule extended by two-fold”

Chip assembly and test disruption, shipment 'emergency'

Soaring demand… End-of-year extension inevitable

Aiming to lead expansion of domesti

The Outsourced Semiconductor Assembly and Test (OSAT) industry is in a state of emergency to secure new equipment. This is because the time (lead time) from ordering equipment to stocking has more than doubled. The semiconductor equipment supply shortage is spreading in all directions from the front-end process to the back-end process.

Despite the urgent need to expand production facilities due to the supply shortage, this will not be enough, and the supply shortage of semiconductors is in a vicious cycle.

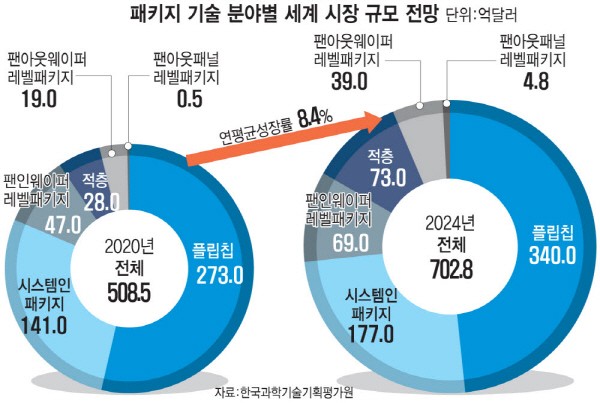

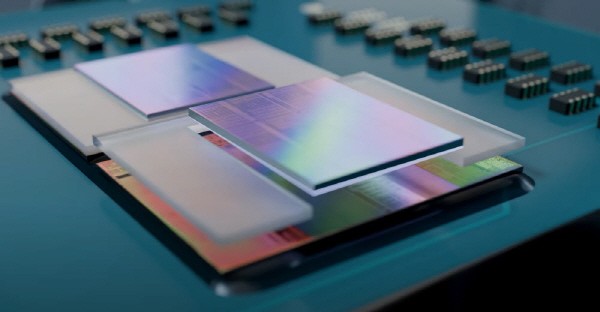

According to the packing industry, the lead time of semiconductor equipment for back-end processing, used in semiconductor chip assembly and testing, has increased by more than double on average across all areas. The lead time, which was initially 6 months, has been extended to more than 12 months. In other words, if you order back-end processing equipment, you will receive it after a year. An official from the semiconductor industry said, “The lead time of advanced process equipment, such as fan-out (FO) as well as mature back-end process equipment such as wafer level package (WLP) and flip chip, has nearly doubled," adding, "OSAT companies that have not ordered equipment in advance are having difficulties in facility investment.”

It has been confirmed that the lead time for advanced processing equipment also increased from the usual 3-4 months to 6-8 months. The long lead time continues despite the demand for advanced process equipment being lower than that of mature processes because the market share is not large.

In particular, the lead time for 'cutting' equipment, that cuts the package and test equipment, has become relatively long. The lead time of DISCO equipment from Japan, a strong contender in the semiconductor cutting equipment market, was found to be one year and six months.

An official from the semiconductor equipment industry said, “Since DISCO is focusing on responding to the demand for wafer cutting equipment suitable for entire processes, the supply of back-end processing equipment such as package cutting is being pushed to a lower priority," adding, "Since test equipment is also being prioritized in the market, the lead-time for back-end process is getting more delayed." On the test equipment side, it is understood that the delivery period for Teradyne in the U.S. and Advantest in Japan has also been extended.

The reason supply and demand shortage of equipment has worsened, from front-end to back-end processes, is because investments were too concentrated at once. Global semiconductor manufacturers and OSAT companies are putting their efforts to expand production capacities for back-end processes, since commercialization of advanced microprocessing has been slow.

Although back-end process equipment is highly dependent on foreign products, suppliers are more diverse than front-end equipment. Even though there are many substitutes, the worsening equipment supply shortage means that demand has increased compared to supply. Semiconductor manufacturers such as Samsung Electronics, TSMC, and Intel have rapidly increased their investments in order to solve the technological limitations of the front-end process with back-end processes. Micron is also expanding investment in back-end process facilities in the Philippines and Taiwan.

Delays in the delivery of back-end process equipment are showing signs of prolonging until the end of this year. Amkor, a global OSAT company, will increase its capital expenditures (CAPEX) this year by 22% compared to the previous year. This is in response to market demand and to catch up with ASE, the leader in the market. ASE is also likely to expand facility investment in response to growing demand. It has been revealed that major domestic OSAT companies will invest almost twice as much in facilities compared to the previous year. Competition to secure equipment first is expected to intensify.

Some observers believe that domestic companies will get reflected profits. The relatively short lead time compared to foreign products has emerged as a competitive advantage. OSAT companies that are having difficulties in being supplied foreign equipment, are considering domestic equipment as an alternative.

By Staff Reporter Dong-jun Kwon djkwon@etnews.com