Korean companies are leading the market as 5 Korean companies account for top 10

Producing beyond domestic facilities, industry expands to overseas for production facilities

Enhancing competitiveness

EcoPro BM and LG Chem listed as the first and second places in the global battery cathode material market last year. There were five Korean companies listed among the top 10 global lithium-ion ternary cathode material manufacturers. Following battery cells, the 'K-battery' will be expanding to the cathode material market.

On the 15th, EcoPro BM produced 75,000 tons of ternary battery cathode materials last year according to a global battery market research company, Benchmark Mineral Intelligence (BMI), which puts it to the No.1 for production in the world. LG Chem (61 thousand tons), Japan's Nichia (48.6 thousandt tons), and Belgium's Umicore (42 thousand tons) followed EcoProBM, respectively. And Samsung SDI (35,000 tons), POSCO Chemical (29.7thousand tons), and LNF (25.5 thousand tons) followd as 8th, 9th and 10th, respectively.

Korean companies accounted for half of the top 10 companies. These companies produced mainly ternary NCM (nickel, cobalt, manganese) or NCA (nickel, cobalt, aluminum). There were more 6·2·2 NCM ratio than than 8·1·1.

Last year, the world's cathode material production was 1.24 million tons, of which 888 thousand tons were ternary batteries, and 353 thousand tons were lithium iron phosphate (LFP).An overwhelming share accounted for ternary batteries, and Chinese companies were the main players for production of LFP batteries.

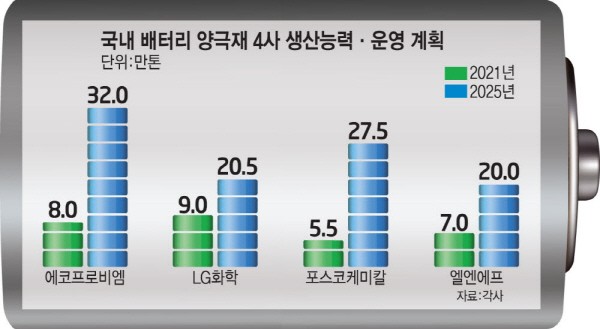

To strengthen domestic dominance in the electric vehicle battery market. the domestic cathode material industry plans to expand its production facilities to the US and Europe. EcoProBM, LG Chem, POSCO Chemical, and LNF have confirmed the production capacity of cathode materials for electric vehicles to 1 million tons by 2025.

An official from a cathode material company said, “Three domestic battery companies as major suppliers for cathode materials. the market is expected to expand continuously for some time according to demands. The competitiveness of the domestic cathode material industry will be further increase if we depend less on Chinese companies for raw material supplies and diversify our customers.”

The industry predicts that the demand for cathode materials will increase by more than eight-folds, from 730,000 tons in 2020 to 6.05 million tons in 2030.

By Staff Reporter Taejoon Park (gaius@etnews.com)