The price of high-purity quartz (quartz), which is one of the raw materials for semiconductor processing part skyrocketed by more than 10%. The demand for process consumables has increased significantly because production capacity of semiconductor manufacturers has increased. There will be a downturn of profits in the semiconductor materials and parts industry that utilizes quartz. Quartz raw materials costs half of the profit; thus some quartz manufacturers are looking for solutions, such as material internalization and vertical integration.

An official from a quartz component manufacturer said “The market price for quartz used in semiconductor process parts soared by more than 10%. The rise of price was significant last year in the midst of trend of price increase.” Quartz used for semiconductors is used for holding wafers, and is a core material for various consumables such as internal of focus ring and process chamber that are etching together.

The rise in quartz prices is due to a surge in demand. The demand for quartz products increased as the production capacity of semiconductor manufacturers, such as Samsung Electronics and SK Hynix, increased. The process and etching steps increased particularly in order to implement a fine semiconductor circuit, and the consumption increased due to parts that are frequently worn out from strengthening of plasma output. Uncertain raw material supply and demand that is affected by the changes in the global supply chain also was a reason for rising price of quartz.

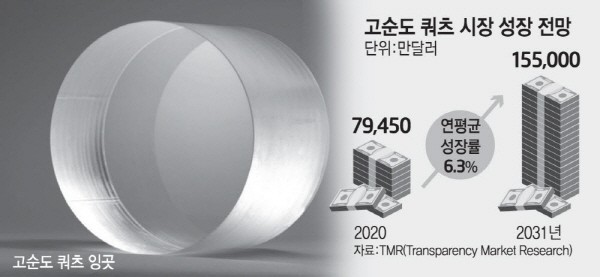

The total high-purity quartz market in 2020 reached KRW 960 billion according to market research firm TMR, and the market is expected to increase at an average annual rate of 6.3% for next ten years.

The profit of the quartz component manufacturer will likely decrease when the quartz raw material supplier raises the price. Quartz parts for semiconductors being 40-45% of the total material cost is the reason for this phenomenon. An official from the semiconductor industry said, "The price of quartz parts must also rise according to the rise in raw material prices; however, it would be difficult to increase the unit price due to the nature of consumables. Currently, America’s Momentive Quartz Technologies, German’s Heraeus and QSIL, and Japan’s Tosoh take up 80% of the global quartz market.

Certain quartz parts manufacturers are trying to secure a stable supply chain for raw materials, and minimize the impact of price increases. Korea's leading quartz parts manufacturers are Wonik QnC, Kumkang Quartz, Young Shin Quartz, DS Techno, Worldex, and SKC Solmics, and among these companies, Wonik QnC succeeded in vertically integrating the US Momentive Quartz division. Wonik QnC’s success suggests that it is possible to assure a stable supply chain by securing a major quartz supplier. Another quartz component manufacturer also reported that internalization for quartz is in process.

An industry official said, "It has become necessary to secure a stable supply chain in response to the continuous upward trend in quartz prices. Manufacturers are cooperating with a quartz supplier and establishing a supply contract that has fixed price for many years in order to ensure price competitiveness.”

By Staff Reporter Dongjoon Kwon (djkwon@etnews.com)