20% decrease from 2019 to last year

Asia region had increase of sales by 3 times during the same period

Proof of insufficient investment in U.S. semiconductor production infrastructure

Despite the ado

It was confirmed that sales to the U.S. of ASML, a global semiconductor equipment maker, have declined for the past three years in a row. This contrasts with sales growth of up to three times in South Korea and Taiwan during the same period. ASML sales, which have dominated the exposure equipment market, are a measure of the country's investment in semiconductor facilities and production capacity. It has been proven that the U.S. investment in semiconductor production infrastructure was insufficient.

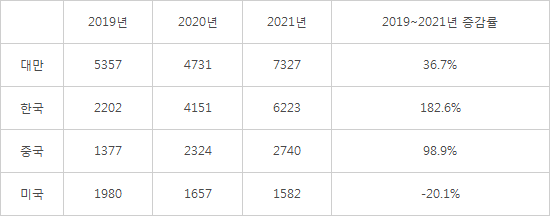

According to ASML's latest annual report for 2021, ASML's revenues in the U.S. decreased by about 20% from 2019 to last year. In 2019, ASML sales to the U.S. were 1.98 billion EUR (about KRW 2.7 trillion). It has decreased to 1.657 billion EUR in 2020 and 1.583 billion EUR in 2021.

During the same period, sales in Asia increased significantly. In South Korea, a major semiconductor production base, sales nearly tripled from 2.202 billion EUR in 2019 to 6.223 billion EUR last year. Taiwan also increased by 37% from 5.357 billion EUR in 2019 to 7.327 billion EUR last year. It is interpreted as the result of introducing a large number of extreme ultraviolet (EUV) equipment to expand advanced micro processing capabilities by Samsung Electronics and SK Hynix. Taiwanese TSMC's aggressive semiconductor facility investment also led to an increase in sales to Taiwan.

Even in China, where the U.S. blocked the export of EUV exposure equipment, which is a key ASML equipment, annual sales doubled. Sales to China increased from 1.377 billion EUR in 2019 to 2.74 billion EUR last year. It is analyzed that China has purchased more exposure equipment than the United States. It seems that exposure equipment such as argon fluoride (ArF), krypton fluoride (KrF), and I-line were mainly introduced except for EUV equipment that is subject to regulation.

ASML accounts for 84% of the global exposure equipment market. For EUV equipment required for advanced processes, ASML exclusively supplies them. The amount of AMSL equipment introduced can affect semiconductor production capacity. This is the background that ASML equipment is used as a measure of investment in semiconductor facilities.

The decline in ASML sales to the U.S. proves that U.S. investment in semiconductor production infrastructure has been insufficient so far. By 2020, the U.S. lacked the will to invest in semiconductor fabs. It is believed that it was influenced by Intel's announcement of entry into the foundry business was late and Micron was once skeptical about EUV equipment.

As the U.S. attracts semiconductor production bases in its own country, the introduction of ASML equipment is expected to accelerate in the future. Intel is planning to adopt ASML next-generation exposure equipment by 2025, and Micron also formalized the use of EUV equipment.

However, the industry predicted that the U.S. semiconductor production capacity would not immediately overwhelm Taiwan and South Korea. An official from the semiconductor industry said, “The number of EUV units, which are the main sales and core equipment of ASML, are 80 units in Taiwan and 50 units in South Korea, which is a gap with the U.S.. Aggressive U.S. investment will not cause short-term capacity reversal.”

<ASML major sale changes by regions >

(Unit : million Euro)

Reference=ASML

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)