CATL, the world's No. 1 electric vehicle battery company, is shaking. This is due to the "CATL exit" movement among Chinese automakers. There has been a reduction in CATL battery supplies, and there have even been cases where companies have changed to completely different battery suppliers.

China's leading electric vehicle companies Xpeng and Guangzhou Automobile recently changed their battery suppliers from CATL to CALB. BMW also recently switched their primary battery supplier from CATL to EVE. Furthermore, Tesla, Nio, and Volkswagen, which used CATL batteries, also began negotiating supply with BYD, which has the second-largest market share in China.

Chinese automakers have begun to reduce their dependence on CATL batteries one after another. This is the aftermath of unstable product supply and demand, due to a significant increase in CATL customers in the last 1~2 years. This is because more and more vehicles are being equipped with ternary (NCM) batteries rather than CATL's flagship lithium iron phosphate (LFP) batteries.

Another weakness is that CATL production plants are mainly concentrated in China. For automakers aiming to enter overseas markets, collaborating with battery makers with overseas production bases tend to stand out. In addition, technological advances from competing companies is also playing a role.

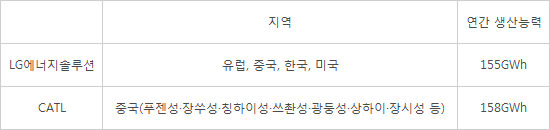

CATL's leading status is also expected to falter. CATL topped the global electric vehicle battery market last year, accounting for 29.0% of market share. It was about 7% ahead of LG Energy Solution (22.2%) which came in at second place. While CATL customers are leaving, LG Energy Solution is steadily increasing its production capacity by securing new customers. LG Energy Solution has also increased its annual production capacity to 155 GWh by expanding overseas plants in Europe and the United States. It was in close pursuit of CATL's 158 GWh production capacity. Professor Chul-wan Park of Seojeong University predicted, "As domestic and foreign sales of Chinese automakers increase, demand for battery supply diversification, LFPs, and ternary batteries is also increasing," and he further added, "There could be opportunities if South Korean battery companies make investments in China."

【Table】 LG Energy Solution and CATL battery plant status

By Staff Reporter Tae-jun Park (gaius@etnews.com)