Samsung Display solidifies their dominance in medium size OLED

The world's only OLED manufacturer for laptops

Preparing for conversion to 8thgenerationprocessfor Apple

LGD, BOE, JOLED are also joinin

The growth of the mediumsize organic light emitting diode (OLED) market is a significant change not only for Samsung Display but also for the domestic display industry. This growth means that a new opportunity is opening up in the OLED industry led by Korea. OLED has grown mainly on smartphones in the meantime.

Samsung Display succeeded in massproducing OLED for the first time in the world in October 2007 and applied it to smartphones from 2009. However, 10 years after the application on smartphones, the growth of OLED for smartphones has slowed. In fact, the sales of Samsung Electronics and Apple, the first and second largest smartphone makers, have remained at around 300 million units and 200 million units respectively for several years. The OLED display industry needed a new driving force. They tried to mount OLEDs on tablets and laptops. However, the demand did not accelerate.

The situation has changed dramatically with COVID-19. As non-face-to-face demand exploded due to the prolonged COVID 19, the adoption of OLEDs, focused on laptops, increased rapidly. As non-face-to-face becomes more common, they are looking for a tablet or laptop with better performance, which would be an OLED.

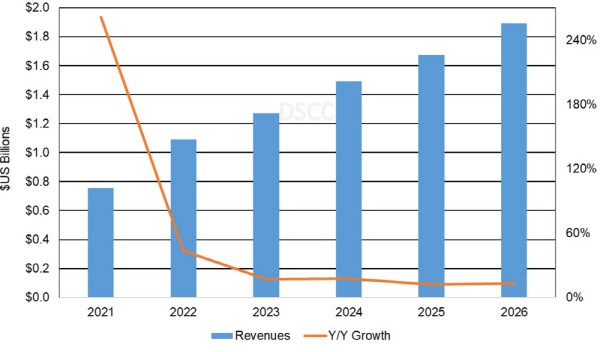

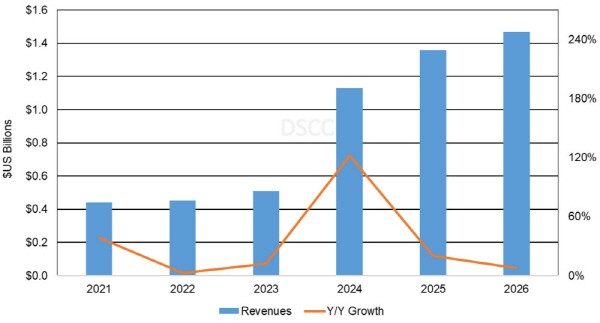

In response to the rapid market change, display market research firm DSCC raised their forecast for the laptop OLED market, which was expected to grow at a CAGR of 17% until 2025, to a CAGR of 26% until 2026. According to DSCC, the size of the OLED market for laptops is expected to form $8.2 billion (about 9.8 trillion KRW) over six years from 2021 to 2026, and tablets will reach $3.9 billion (about 4.7 trillion KRW) during the same period.

Samsung Display is the world's only OLED manufacturer for laptops. The tablet OLED market share also exceeds 50%. For tablet OLEDs, CSOT and Everdisplay are also being released. Samsung Display has expanded their territory from small to mediumsize OLEDs based on advanced OLED technology for smartphones. In addition, it is highly likely that they will continue their dominance in the laptopand tablet market by pioneering a leading market. LG Display, BOE, and JOLED are expected to tighten the reins as the medium size OLED market is growing. LG Display is preparing to produce medium-sized OLEDs with the goal of operation in 2024, and BOE and JOLED are also paying attention to medium-sized OLEDs.

For the future growth of the medium size OLED market, Apple's entry is considered the most important factor. It is analyzed that a 'Quantum jump' in the OLED market is possible if OLEDs are also installed in iPads and MacBooks. Apple is the No. 1 company in the tablet market and has a strong influence on the information technology (IT) industry, so it can further speed up the spread of OLED. According to the industry, Apple is considering OLED installations for iPads in 2023-2024 and MacBooks in 2024~2025.

Display makers are preparing to respond to Apple. Samsung Display and LG Display are developing OLEDs for Apple's iPad, and are preparing to convert the current 6thgeneration OLED manufacturing process to 8thgeneration in preparation for mounting on MacBooks. The higher the generation, which means the size of the glass substrate is larger, and larger displays can be efficiently produced. When productivity is improved, panel unit cost can be lowered, which leads to wider adoption.

8thgeneration OLED mass production is expected in 2023-2024. Accordingly, it is expected to finish the development of equipment and materials necessary for manufacturing 8th generation OLED by next year and start operation in 2023. Ki-hyun Kim, director of Stone Partners, said, “The goal of 8th generation OLED conversion is to apply IT products such as tablets, laptops, and monitors.If commercialization is successful, the LCD market will shrink and the OLED market will expand even faster.”

By Staff Reporter Gun-il Yun (benyun@etnews.com)