A “future vehicle – semiconductor joint consultative group”, which was launched on Thursday, is expected create new opportunities in the midst of severe short supply of automotive chips as there is a greater chance for South Korean automotive chip companies to be connected to automakers that the chip makers have been greatly looking for.

The reason why automotive chips have recently been on short supply is because automotive chip companies were caught off guard by a sudden increase in demands for cars that started to take place at the end of last year. Experts believe that semiconductor companies that were focused on production of semiconductors for IT devices were not prepared for the increase in demands for automotive chips. Some believe that the current short supply will be resolved sometime in September.

Fortunately, Hyundai Motor Company is not facing a huge crisis yet as they have stocks of automotive chips saved up.

However, experts believe that Hyundai Motor Company will not be free from the current issue as the phenomenon is affecting automakers around the world.

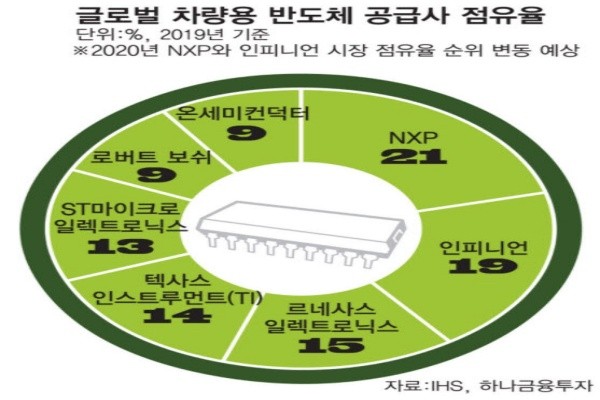

It is reported that Hyundai Motor Company is also highly dependent on foreign automotive chip makers. Currently, NXP based in Netherland, Infineon based in Germany, and Renesas based in Japan each own about 20% of the global automotive chip market and hold a dominant position in the market. As a result, Hyundai Motor Company may not be free from this supply chain.

One official from the industry said that Hyundai Motor Company is looking into adjusting its production in order to deal with the automotive chip issue.

The consultative group will allow South Korean automakers to be less dependent on foreign automotive chip makers and create new opportunities to grow traditional system semiconductor companies.

Although a variety of fabless companies such as Telechips, Nextchip, Silicon Works, and PIXELPLUS have been trying to localize production of automotive chips, limited opportunities for cooperation have always been an obstacle for them to succeed in localization.

“Even if we are capable of developing automotive chips, we still need to find a buyer or an automaker that is willing to participate in joint research.” said CEO of a fabless company. “The consultative group will build a stronger relationship between South Korean companies and create an opportunity for the ecosystem to grow.”

The consultative group will also accelerate development of automotive chips based on new technologies. For example, although automotive chips are normally made through 8-inch wafers, VSI plans to make SerDes-based (Serializer and Deserializers) chips through 12-inch wafers.

Kang Soo-won, who is the CEO of VSI, said that although production of automotive chips is being delayed due to a bottleneck situation that is taking place in the 8-inch foundry, which is a legacy process, using the latest 12-inch foundry process will create new opportunities for the company.

Staff Reporter Kang, Hyeryung | kang@etnews.com