“SEMICON Korea 2021”, which is going to be held virtually for the first time, will examine new trends in the global semiconductor market. Particularly, SEMI (Semiconductor Equipment and Materials International) predicts that markets for materials, parts, and equipment used for semiconductor production will make a huge growth due to demands for chips that have been increasing rapidly since the global pandemic.

“Market Trend Forum”, one of many programs that will take place during SEMICON Korea 2021, is expected to be a program that will take about recent trends in the global semiconductor market and predict which direction the market will head towards. SEMI plans to show current situations and predictions on the global semiconductor market by using various numbers and statistics at the forum.

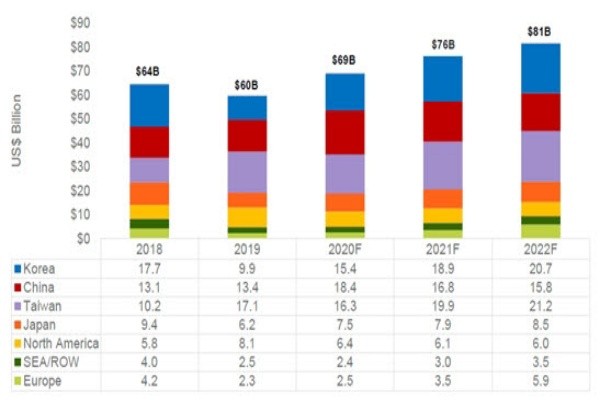

SEMI is predicting a very positive forecast for the global semiconductor market this year. It estimated that global sales of semiconductor equipment in 2021 would be $76 billion which would be an 10% increase from 2020 ($69 billion). Such amount will be the highest since 2018 when SEMI started recording global sales of semiconductor equipment. It is estimated the global sales in 2022 will be higher than this year at $81 billion.

The reason why the forecast of the global semiconductor equipment market is looking very positive is because demands for semiconductors have been growing rapidly since the global pandemic. As semiconductor sales have been increasing at the same time as sales of IT devices such as laptops and servers that use semiconductors as people have been staying home more to prevent the spread of COVID-19, semiconductor companies around the world have been making investments to expand their semiconductor production lines. Furthermore, development of markets for 5G, autonomous driving and electric vehicles will only accelerate global sales of semiconductor equipment even more.

Looking at sales per country, SEMI estimated that sales in South Korea would be $18.9 billion which would be second highest after Taiwan. There are companies such as Samsung Electronics and SK Hynix in South Korea that take up about 70% of the global memory semiconductor market.

Both companies predict a positive forecast for the global memory semiconductor market in 2021 and are planning investments to secure cutting-edge semiconductor technologies and to expand their current production lines. Samsung Electronics is expected to gradually increase production of its next-generation DRAMs and NAND flash memories mainly through its state-of-the-art fab in Pyeongtaek and its second plant in Xian that is its overseas NAND flash production plant. SK Hynix completed the construction of the M16 fab located in Incheon and plans to start production of its 4th-generation 10nm-class DRAMs utilizing EUV (Extreme Ultraviolet) technology in the second half this year.

Fierce competition between Taiwanese semiconductor companies and South Korean semiconductor companies will also be worth paying close attention to. While the global foundry market is facing an unprecedented short supply phenomenon, Samsung Electronics and TSMC are engaged in a fierce competition to secure microfabrication processes under 5 nm. Along with securing cutting-edge technologies, they will also look to increase their production capacities.

SEMI said that it will analyze and talk about current situations in the global semiconductor market at the forum and that it has prepared various materials that can be helpful for semiconductor materials, parts, and equipment suppliers on making directions of their businesses.

One official from SEMI said that SEMI will also talk about what kind of impact the current COVID-19 situation will have on the semiconductor industry and make presentations on markets for AI, 5G, and semiconductor equipment and materials.

The forum can be viewed online from anywhere and anytime between February 3 and February 12.

Staff Reporter Kang, Hyeryung | kang@etnews.com