South Korean and foreign foundry semiconductor companies have been raising their prices on consignment production of semiconductors one after the other. As a result, there is now financial pressure in addition to short supply from delay in delivery date not only on fabless companies that assign foundry companies with production of semiconductors, but also on the electronics industry that includes IT device manufacturers such as smartphones and data centers.

Companies such as DB HiTek and Key Foundry that have their production plants in South Korea as well as foreign foundry companies such as SMIC based in China and UMC based in Taiwan have already raised their prices or are planning to raise their prices soon. It is reported that the average increase will be somewhere between 10 and 20%. Due to the increase, there is even a service where fabless companies will have their semiconductors produced first if they pay a premium to foundry companies.

It is reported that the short supply is extremely severe in the global market for 8-inch foundry as there has been a huge increase in number of chips such as PMIC (Power Management Integrated Circuit) and DDI (Display Driver IC) that are produced from 8-inch foundry due to a gradual increase in electric vehicle (EV) production from Tesla and others and a heavy increase in demands for IT devices since the global pandemic.

South Korean foundry companies are currently operating their fabs at full capacity. SK Hynix System IC, which plans to transfer production lines from its fab in Cheongju to its fab in Wuxi by early next year, has been working tirelessly to carry out massive orders that have been made to both plants. It is reported that Samsung Electronics that is operating a 8-inch foundry fab in Giheung that has a monthly production capacity of 300,000 wafers already received orders for this year. In the meantime, UMC had to halt some of its production lines due to a power outage. The president for a South Korean fabless company told the Electronic Times that this is the first time that the company is experiencing a such extreme shortage when the company has been in the semiconductor market for tens of years.

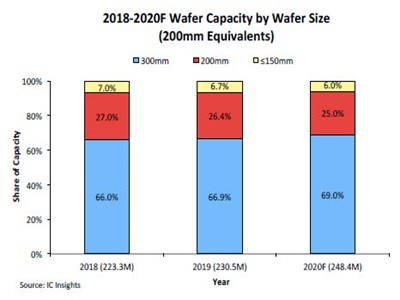

Despite the shortage, foundry companies have not been accelerating construction of additional 8-inch foundry fabs. This is because foundry companies have been focusing their investments in the 12-inch foundry resulting in a gradual reduction in the percentage of 8-inch foundry fabs in the global foundry market. Also, it is not easy for foundry companies to begin expanding their fabs right away in order to satisfy increased demands. It has become nearly impossible to obtain 8-inch foundry equipment that has become a “legacy process”. “Used 8-inch foundry equipment has become so valuable. It is also burdensome to make a decision on building additional plants by raising prices on new 8-inch foundry equipment.” said the president of one semiconductor equipment supplier. “Foundry companies are suggesting the 12-inch foundry process where situations are better. Some equipment suppliers are even converting their 12-inch equipment into 8-inch equipment.”

The fabless industry is facing the direct hit from the short supply. Although fabless companies’ production costs continue to climb, they are in a situation where they cannot just raise their unit costs because they have to consider their price competitiveness. Small and medium-sized fabless companies that lack basic strength are even in a more dire situation. One official from the industry said that even an 10% increase in price is a huge hit to a company’s operation and that such increase can also have a significant impact on development of new chips.

The fact that the short supply issue can impact the entire ICT (Information Communication Technology) industry is even a bigger issue. Experts predicted that the automotive industry can face setbacks to its production and that first-half output of the entire electronics industry can be reduced by up to 10% due to an imbalance in supply of parts that are needed to produce major ICT devices such as smartphones, laptops, PCs, and data centers. Samsung Electronics made a statement during a conference that was held on January 28 to report its fourth quarter performance from last year that it is paying careful attention on whether the short supply issue will impact demands from the global mobile device market.

“Short supply will be inevitable for this year as well as it is difficult for foundry companies to bring in new 8-inch foundry equipment.” said Kim Young-woo who is a chief researcher at SK Securities. “Even if each foundry companies builds additional plant this year, there is a chance that there can be a supply and demand issue as demands for wafers increase rapidly starting from next year.”

Staff Reporter Kang, Hyeryung | kang@etnews.com