SK Group plans to make $1.46 billion (1.6 trillion KRW) into an American hydrogen energy company. It will have its affiliated company SK E&S control the “rudder” and expand its hydrogen business.

SK Group made an official announcement that it plans to invest $1.5 billion in Plug Power that is a leading provider of clean hydrogen located in North America. The group will acquire a 9.9% stake in Plug Power and become Plug Power’s largest shareholder.

The investment will be a joint investment. Its American subsidiary Plus Capital will invest $750 billion through its overseas affiliated company called Grove Energy Capital. Remaining $750 billion will come from SK E&S.

Plug Power was established in 1997 and it possesses core technologies in PEMFC (Proton-Exchange Membrane Fuel Cells) for cars, electrolyzer for water electrolysis, and liquid hydrogen plant and hydrogen station construction. Its annual growth rate is about 50%. Its market capitalization was worth about $14.6 billion (16 trillion KRW) at the end of last year.

Plug Power also specializes in hydrogen-based mobility business and it is the exclusive supplier of hydrogen forklifts for multinational distributors such as Amazon and Walmart. It basically monopolizes the entire hydrogen forklift market in the United States. It recently utilized hydrogen station network built throughout the United States and entered the medium and heavy truck market. It is working on having hydrogen fuel cells utilized in many areas such as drones, aircrafts, and power generation and it is also knocking on the door of the European market. It is set to complete the construction of a 1.5GW fuel cell production plant, which will be the biggest in the world, in New York sometime in the second half this year and go into production.

SK Group has prepared a steppingstone to expand its hydrogen business with this investment. The fact that it has chosen a hydrogen energy company as its first biggest investment in 2021 indicates that the company plans to continuously push forward its hydrogen business. It is expected to be a leader in the global hydrogen energy business by being able to reduce production cost from becoming Plug Power’s largest shareholder.

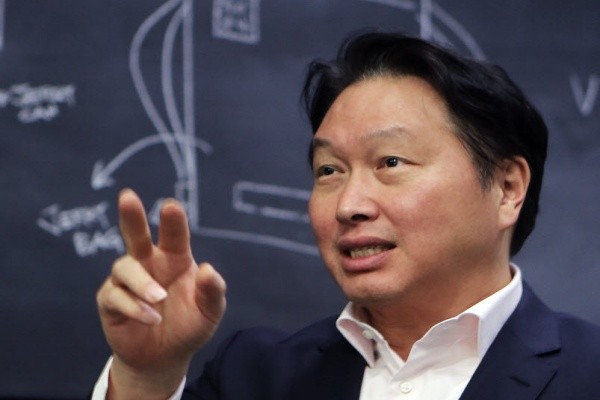

SK E&S will likely be the one that will lead the group’s hydrogen business as it will invest half of the total investment to acquire a stake in Plug Power and President Choo Hyeong-wook of SK E&S is leading the group’s hydrogen business control tower called a hydrogen business task force. The task force has secured a capability to produce 30,000 tons and 280,000 tons of hydrogen energy produced from South Korea by 2023 and 2025 respectively. SK Group established the task force at the end of last year in order to create a value chain of production, distribution, and supply of hydrogen energy.

“Plug Power is a leader in hydrogen energy.” said President Choo. “With this partnership, we plan to raise synergy effect in the group’s hydrogen business and we believe that we will be able to create even a social value.”

One official from SK Group said that the group plans to utilize Plug Power’s technologies to push forward creation of hydrogen energy ecosystem in South Korea and look to grab opportunities in China and Vietnam for development of new projects and that it plans to establish a joint venture with Plug Power and enter the Asian hydrogen energy market together.

Staff Reporter Ryu, Taewoong | bigheroryu@etnews.com