As Apple is set to receive flexible OLED displays from Samsung Display and LG Display for its upcoming iPhone 13 series, South Korean industries for smartphone parts and materials are starting to have high hopes on their performance in 2021. Apple currently sells about 200 million iPhones annually. Supply of flexible OLED displays from Samsung Display and LG Display to Apple indicates opportunities for growth of companies that make necessary parts and materials.

◊Samsung Display to be the main flexible OLED display supplier for the iPhone 13 series

The biggest characteristics of the flexible OLED display that will be used for the iPhone 13 are 120Hz refresh rate and LPTO-TFT (Low-Temperature Polycrystalline Oxide Thin-Film Transistor). 6.1 and 6.7-inch OLED panels that will be used for the iPhone 13 Pro series will provide 120Hz refresh rate and support the LPTO technology. With two times better refresh rate than the iPhone 12’s display, the iPhone 13 will provide a clearer and smoother screen. The LPTO technology will improve power consumption of the flexible OLED display.

Samsung Display is expected to be the main supplier of the 6.1 and 6.7-inch OLED panels. The company already has an experience in supplying LPTO-based 120Hz OLED panels to Samsung Electronics last year for the Galaxy S20 and the Galaxy Note 20 Ultra. As its ability to mass-produce such panels has been verified, there is a good chance that Samsung Display has secured the most amount of supply of OLED panels from Apple.

Samsung Display has developed a technology called “adaptive frequency” technology that minimizes power consumption by automatically adjusting refresh rate depending on a situation. It is likely that Apple will use FreeSync technology that is similar to the adaptive frequency technology for the iPhone 13.

LG Display is expected to supply OLED panels mainly for basic models of the iPhone 13 as it has less experience in the LTPO technology and on-cell touch flexible OLED technology. It will mainly supply 6.1-inch LTPS panels and a portion of LTPO panels.

Some estimate that Samsung Display and LG Display will supply 120 million and 40 million OLED panels respectively.

◊Apple expected to use RFPCBs for all models of the iPhone 13

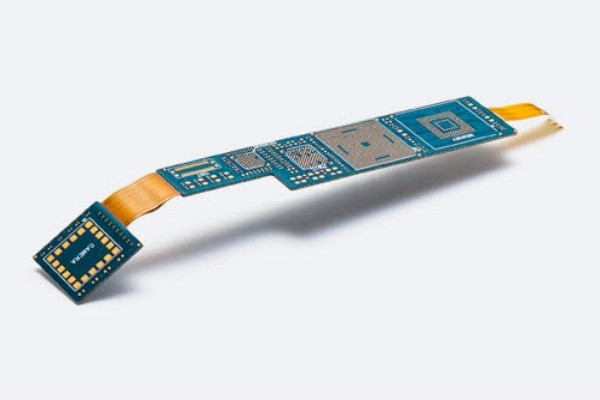

The iPhone 13 is also expected to have a significant impact on South Korea’s PCB (Printed Circuit Board) industry as the iPhone 13’s OLED panels will be using RFPCBs (Rigid-Flex PCB). RFPCB connects the display and the main board and allows signals to be exchanged between the two parts.

For the iPhone 12, Apple only used RFPCBs for 5.4 and 6.7-inch panels. The two 6.1-inch panels used multilayer PCBs. The two 6.1-inch panels are panels that have touch films attached separately while the 5.4 and 6.7-inch panels are on-cell touch flexible OLED panels. In other words, Apple used different kinds of PCBs depending on performance of a panel.

However, Apple is planning to have all OLED panels that will be used for the iPhone 13 use RFPCBs as all four OLED panels will be on-cell touch OLED panels. The fact that the two of the panels that will be used for the iPhone 13 Pro will have higher refresh rate is another reason why Apple is planning to use RFPCBs for the panels.

RFPCBs become part of finished products after going through display manufacturers. BH, Samsung Electro-Mechanics, and Youngpoong Electronics are the ones that have been supplying RFPCBs to Samsung Display for iPhones and there is a chance that they will continue to be the RFPCB suppliers of Samsung Display for the iPhone 13. However, there is a chance that Samsung Electro-Mechanics will not be part of a group of the RFPCB suppliers of Samsung Display as it is looking to withdraw from its RFPCB business. In this case, a supply designated for Samsung Electro-Mechanics will be distributed amongst the other two companies.

LG Display has Taiwanese and Japanese PCB manufacturers as its partners. Because the amount of Samsung Display’s supply will be much greater than that of LG Display, it will be South Korean PCB manufacturers that will benefit the most.

◊South Korean companies chosen as the suppliers of necessary materials for Samsung Display

Samsung Display plans to make its OLED panels using a material set called M11. The M11 set will be used for Samsung Electronics’ Galaxy S21 first and then be used for the iPhone 13 afterwards.

OLED display shows images using materials that are able to emit light on their own. Combination of these materials determines performance and lifespan of an OOLED panel. Samsung Display already selected companies that will supply materials for the M11 set.

Materials from Samsung SDI, Duksan Neolux, and Doosan Solus will be used for the M11 set. Samsung SDI will supply green host while Duksan Neolux and Doosan Solus will supply red+green prime and A-ETL (Electron Transport Layer) respectively. Duksan Neolux will also supply HTL (Hole Transport Layer). If Samsung Display ends up supplying more OLED panels due to popularity of the iPhone 13, the three companies will also benefit. Host and dopant materials emit light within the OLED emissive layers. Prime material raises luminance efficiency of dopant and host materials while HTL and A-ETL are supplemental layers that assist with luminescence.

Besides these three companies, UDC, Dupont, and SFC also put their names up to be part of the suppliers of the M11 set. UDC is an American OLED materials company that has many patents in phosphorescent dopant while Dupont is a multinational chemical company. SFC is a joint company established by Samsung Display and Hodogaya Chemical.

Staff Reporter Yun, Geonil | benyun@etnews.com