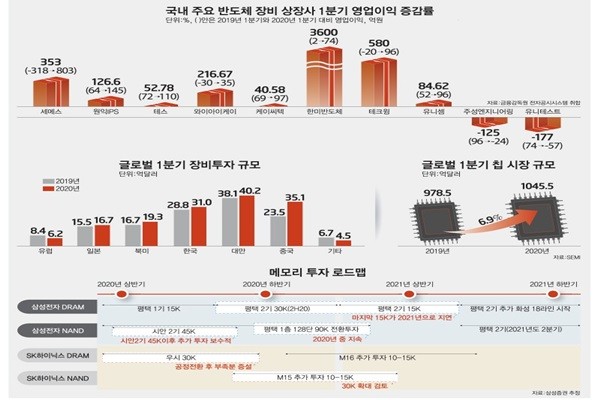

It is shown that South Korea’ top semiconductor equipment makers recorded satisfactory performance in the first quarter despite the global pandemic of COVID-19. Although the front-end market had become worse last year due to a sudden slump within the global memory industry, performance of companies that supplied semiconductor equipment to Samsung Electronics, which resumed its investments in facilities and equipment as demands for memories started to recover at the end of last year, improved noticeably. Within the display equipment industry, companies that were active in pioneering foreign markets such as the Chinese market amidst a slump across the market appeared to put up a good fight.

1st quarter’s performance of South Korean companies that supplied various semiconductor equipment to Samsung Electronics improved significantly. SEMES and WONIK IPS, which are the top two semiconductor equipment makers in South Korea, are prime examples.

SEMES, which is a subsidiary of Samsung Electronics made $64.9 million (80.3 billion KRW) in operating profit in the first quarter. Compared to the first quarter last year when it made $25.7 million (31.8 billion KRW) in deficit, its operating profit increased by more than $80.8 million (100 billion KRW).

It made $433 million (536.4 billion KRW) in sales that is almost 5 times jump compared to first quarter last year. Also, its first quarter sales are almost half of entire sales from 2019 when it made $913 million (1.13 trillion KRW) in sales. It is heard that SEMES is looking to make $1.45 million (1.8 trillion KRW) in sales this year just like in 2018.

SEMES succeeded in localizing contact equipment for NAND flash memory, which was brought from TEL (Tokyo Electron) previously, and delivered it to Samsung Electronics’ Xian Fab 2, which is the new NAND base. By doing so, it displayed potential of South Korean semiconductor equipment makers.

It is heard that SEMES also has been delivering a sizeable number of its main equipment such as cleaning equipment besides contact equipment to Samsung Electronics since the fourth quarter last year and increased its sales.

WONIK IPS is also off to a good start this year. It made $11.7 million (14.5 billion KRW) in operating profit in the first quarter. Compared to its operating profit from the first quarter last year when it made $5.17 million (6.4 billion KRW), its operating profit more than doubled.

It is understood that WONIK IPS has been delivering deposition equipment and furnace annealing equipment to various new facilities of Samsung Electronics such as 5nm line, Xian Fab 2, and Pyeongtaek Fab 2. For the Xian Fab 2, it supplied next-generation molding equipment that can deal with manufacturing of NAND flash memories with more than 100 layers which had a significant impact on its first quarter sales.

TES, which is a key semiconductor equipment supplier of SK Hynix, also put up a good fight by increasing the number of equipment it supplied to Samsung Electronics. In this first quarter, TES made $8.88 million (11 billion KRW) and $47.6 million (58.9 billion KRW) in operating profit and sales respectively. Its operating profit rate drew near 20%. Its operating profit increased 52% compared to the first quarter last year.

“TES is delivering hard mask deposition (amorphous carbon layer) equipment and dry etching (gas phase etching) equipment evenly to Samsung Electronics.” said a representative for the industry.

Companies that specialize in the back-end process also benefited from Samsung Electronics’ investments. While YIKC, which makes semiconductor inspection equipment, made $9.61 million (11.9 billion KRW) in operating loss last year due to lack of investments from semiconductor manufacturers, it made $2.83 million (3.5 billion KRW) in operating profit in the first quarter due to Samsung Electronics’ new investments.

While Samsung Electronics’ investments acted as opportunities for semiconductor equipment makers, display equipment makers sought opportunities from foreign markets rather than the South Korean market.

AP System, which makers OLED panel manufacturing equipment, made $6.38 million (7.9 billion KRW) in operating profit in the first quarter that is more than a two-fold jump compared to the first quarter last year.

AP System’s sales increased by a lot as it delivered its products to Chinese display makers BOE and CSOT. It obtained $121 million (149.3 billion KRW) worth of orders from BOE in February and it signed a supply contract worth $68.5 million (84.8 billion KRW) with CSOT in January.

Another display equipment maker called DMS also found opportunities from foreign markets. Its operating profit in the first quarter, which was $4.12 million (5.1 billion KRW), also jumped more than two times compared to the first quarter last year.

DMS made a positive performance in the first quarter by exporting its products to Chinese display makers such as CSOT and others.

There is also a company that improved its profit by diversifying its customers rather than relying on specific customers. HANMI Semiconductor made $31.6 million (39.1 billion KRW) and $5.73 million (7.1 billion KRW) in sales and operating profit respectively in the first quarter. Its first quarter operating profit was almost half of its entire operating profit from last year. More than 70% of its sales comes from exports and it is rare to see a South Korean semiconductor equipment maker with such diversity in customers. It is the world’s top company when it comes to “vision placement system” that handles chip cutting, cleaning, inspection, and loading.

On the other hand, companies that have high levels of dependence on particular customers showed poor performance in the first quarter. JUSUNG Engineering had supplied its semiconductor equipment mostly to SK Hynix. However, its sales from the semiconductor sector plummeted as SK Hynix has shown a very conservative approach towards its investments this year. While its sales from semiconductor equipment in the first quarter last year were $26 million (32.2 billion KRW), its sales from the first quarter dropped to $12.6 million (15.6 billion KRW).

UniTest, which supplies its memory testing equipment to SK Hynix, also experienced a poor performance in the first quarter. Its sales from semiconductor inspection equipment dropped 56% from $17.4 million (21.6 billion KRW) in the first quarter last year to $7.11 million (8.8 billion KRW) in the first quarter. It also manufactured 21 equipment in the first quarter that is a 36% reduction compared to the first quarter last year. Its poor performance in the first quarter is expected to convert its surplus to a deficit.

“In order to minimize risks, semiconductor and display equipment makers have recently been focusing on diversifying its customers.” said a representative for the equipment industry.

Staff Reporter Kang, Hyeryung | kang@etnews.com