Samsung Display once again held the top spot within the global mobile rigid OLED market in this past first quarter. It was responsible for more than 90% of entire shipments and recorded an overwhelming performance compared to its competitors. As the number of premium smartphones equipped with OLED display is increasing, it is expected that Samsung Display will be far ahead of its competitors for a while.

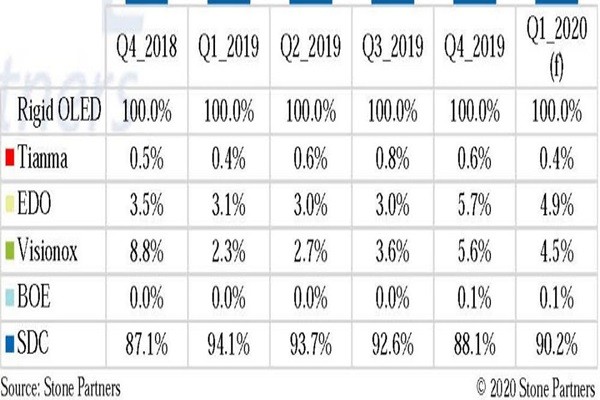

According to a market research company called Stone Partners, Samsung Display shipped 61.6 million mobile rigid OLED panels in this past first quarter alone. Out of entire shipments that are estimated to be 68.3 million panels, its shipments were responsible for 90.2%. Although this percentage is a 3.9% drop compared to Samsung Display’s market shares in the first quarter of 2019 (94.1%), it is shown that Samsung Display actually shipped 2 million panels more in this past first quarter compared to the first quarter of 2019.

There was a clear difference between Samsung Display and Chinese display makers that are competing against Samsung Display. EDO shipped 3.3 million panels and held the second spot with 4.9% market shares. Visionox shipped 3.1 million panels (4.5%) and was a close third after EDO. Both of these companies shipped 1 million panels more in this past first quarter compared to the first quarter of 2019 and are continuing to rapidly expand their rigid OLED panel businesses. Tianma and BOE shipped 200,000 and 100,000 panels respectively.

“Numbers of rigid OLED panels supplied by Chinese makers to major smartphone companies are currently insignificant.” said a representative for the industry. “Tianma’s production capacity will be even lower as it will start making investments in order to convert its current rigid OLED panel production line into a flexible OLED panel production line.”

It is expected that Samsung Display will begin increasing the amount of supply of rigid hole OLED panels starting from this year. This panel maximizes effects of a full screen as it has a hole designed for a camera module. Although this panel has been used mostly for premium smartphones with flexible OLED panels, it is also beginning to be used by low-end and middle-end smartphones as well. In 2019, Samsung Electronics applied rigid hole OLED display to one of its economic Galaxy series model.

The fact that major smartphone manufacturers are continuing to apply OLED displays to their products is another indication that Samsung Display will not have any major competitor for a while. Numbers of low-end and middle-end smartphones with OLED panels are starting to go up as the number of users who enjoy watching videos and playing games. A market research company called Counterpoint Research is estimating that the sales volume of smartphones with OLED display in 2020 will be around 600 million units that is an 46% increase compared to that of last year.

“It is understood that Samsung Display’s position within the global rigid OLED panel market will be even stronger as it starts to increase amounts of supply of rigid hole OLED panels.” said a representative for Stone Partners. “It is likely that Samsung Display’s market shares will stay above 90% for a while.”

Staff Reporter Yoon, Heeseok | pioneer@etnews.com