As South Korea’s insurance industry’s conditions continue to get worse, insurance companies are offered up for sale one after the other. Recently, one of top South Korean insurance companies called Prudential Life Insurance Company of Korea has been made available in the M&A market. KDB (Korea Development Bank) is also looking to sell KDB Life Insurance. The future of South Korea’s life insurance is also not bright as profitability continues to get worse due to low interest and low growth and as low birth rate continues to get higher. Majority within South Korea’s insurance industry believes that reorganization will be inevitable for the industry in the near future.

As South Korea’s insurance industry’s conditions continue to get worse, insurance companies are offered up for sale one after the other. Recently, one of top South Korean insurance companies called Prudential Life Insurance Company of Korea has been made available in the M&A market. KDB (Korea Development Bank) is also looking to sell KDB Life Insurance. The future of South Korea’s life insurance is also not bright as profitability continues to get worse due to low interest and low growth and as low birth rate continues to get higher. Majority within South Korea’s insurance industry believes that reorganization will be inevitable for the industry in the near future.

◊Prudential Life Insurance and KDB Life Insurance Put up for Sale

Prudential International Insurance Holdings’ Prudential Life Insurance and KDB’s KDB Life Insurance are currently going through selling their businesses.

First, Prudential International Insurance Holdings selected The Goldman Sachs Group as the company that will oversee the sales process. As of now, KB Financial Holdings, Hahn & Company, MBK Partners, and IMM PE are selected as candidates to acquire Prudential Life Insurance and they are currently going through screening process and interviews by The Goldman Sachs Group. The Goldman Sachs Group is planning to carry out official tender sometime in the middle of March.

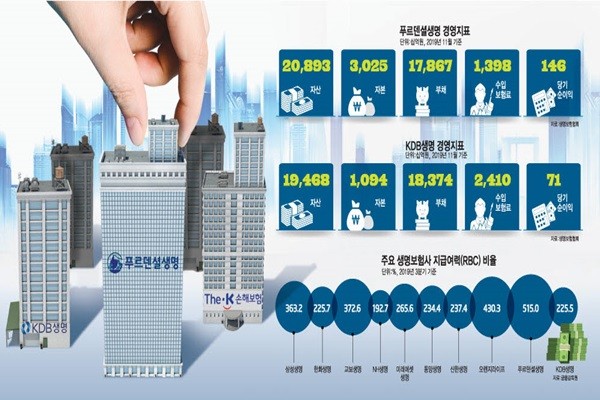

Prudential Life Insurance was established in 1989 by Prudential International Insurance Holdings that is a subsidiary of Prudential Financial. Although it is not a top insurance company, it is seen as an excellent company. Although it was placed 11th out of 24 life insurance companies based on amount of assets as of the end of last November, it was ranked 7th based on net profit. On the other hand, its RBC (Risk-Based Capital) ratio is the highest at 515%. This percentage indicates that it has an ability to pay up to $4,364 (5.15 million KRW) when its customer claims $848 (1 million KRW) in insurance.

Unlike insurance companies based on high-interest deterministic products that were put up for sale in the past, Prudential Life Insurance’s portfolio is based on coverage insurance and variable insurance. While high-interest deterministic products has a high chance of reverse margin due to low operating profit from a low interest trend, variable insurance invests part of premium in marketable securities and does not have set amount of surrender value as it is based on a structure that distributes profits.

Fact that it is seen as an excellent company is another reason why it is seen as an attractive sale for financial holdings and PE funds. Although Tong Yang Life Insurance, which is currently ranked 6th based on amount of assets, is mentioned as a potential sale, it is yet to be on a list of sale. As a result, financial holdings that are looking to gain competitive edge in non-financial fields are eyeing Prudential Life Insurance.

Actually, KB Financial Holdings is participating in acquisition process of Prudential Life Insurance in order to gain competitive edge in non-financial fields. Although it already has KB Life Insurance as a subsidiary, it can jump up to 5th place if it acquires Prudential Life Insurance. Also, it will also be able to take back the “leading bank” position from Shinhan Financial Holdings. PE funds are also strong candidates to acquire Prudential Life Insurance because there was a previous instance when MBK Partners profited huge amount of money by acquiring Orange Life and reselling it to Shinhan Financial Holdings.

KDB Life Insurance is going through a sale process for the 4th time. It is currently ranked 13th based on amount of assets and it was ranked 12th at the end of last November based on net profit. It was able to raise RBC ratio to 225.5% by the end of the third quarter of 2019 by issuing subordinated security bonds.

While Samil PricewaterhouseCoopers, which is the company that oversees the sale process of KDB Life Insurance, conducted a preliminary tender at the end of last year, it has yet to find an appropriate candidate. However, there is a high chance that it will be able to find an appropriate candidate soon as Chairman Lee Dong-geol of KDB is determined to sell KDB Life Insurance. “We are going to be very flexible regarding negotiating the cost to acquire KDB Life Insurance.” said Chairman Lee during a press conference that was held in last December.

The industry believes that the sale process of KDB Life Insurance will be resumed soon when Prudential Life Insurance finds the appropriate buyer.

In addition to Prudential Life Insurance and KDB Life Insurance, Tong Yang Life Insurance and ABL are also mentioned as potential sellers because Anbang Insurance Group, which is the parent company of the two, is currently managed by Chinese Government as it was basically broken up by Chinese Government. Out of non-life insurance companies, The-K Non-life Insurance is currently going through a sale process while MG Non-Life Insurance is mentioned as a potential seller.

◊Acquisition price to be the key factor

Acquisition price is the key factor for the future of KDB Life Insurance and Prudential Life Insurance. It is estimated that it will cost $1.70 billion (2 trillion KRW) to purchase Prudential Life Insurance. However, because Shinhan Financial Holdings spend more than $2.54 billion (3 trillion KRW) to purchase Orange Life, there is a chance that the price of Prudential Life Insurance will be around $2.54 billion as well as competitions become fiercer. Actually, it is heard that The Goldman Sachs Group quoted $2.71 billion (3.2 trillion KRW) through an IM (Information Memorandum). Chairman Yoon Jong-kyu of KB Financial Group emphasized repeatedly that KB would not overpay to purchase Prudential Life Insurance.

KDB’s biggest goal is to recover funds that were invested in KDB Life Insurance. Previously, KDB expected that the sale price of KDB Life Insurance would be more than $509 million (600 billion KRW) considering the amount of its investments that went into KDB Life Insurance. KDB has currently invested about $848 million (1 trillion KRW) in KDB Life Insurance. However, it is heard that two PE funds that are participating in a preliminary tender offered $170 million (200 billion KRW) to purchase KDB Life Insurance.

As insurance companies have been put up for sale, it is likely that the insurance industry will go through reorganization soon. As of the end of last November, amounts of assets for top three life insurance companies were $238 billion (281 trillion KRW) for Samsung Life Insurance, $103 billion (121 trillion KRW) for Hanwha Life Insurance, and $90.7 billion (107 trillion KRW) for Kyobo Life Insurance followed by NH Life Insurance ($54.2 billion (64 trillion KRW)), Mirae Asset Life Insurance ($30.5 billion (36 trillion KRW)), Tong Yang Life Insurance ($28.0 billion (33 trillion KRW)), Shinhan Life Insurance ($28.0 billion (33 trillion KRW)), and Orange Life Insurance ($28.0 billion (33 trillion KRW)). However, a merger between Shinhan Life Insurance and Orange Life Insurance will create a life insurance company with $55.9 billion (66 trillion KRW) in amount of assets and jump to 4th place. A merger between KB Life Insurance and Prudential Life Insurance will also create a life insurance company with more than $25.4 billion (30 trillion KRW) in amount of assets. As a result, life insurance companies tied to financial holdings besides NH Life Insurance that are small in size compared to other life insurance companies will gain more influence within the industry.

“In case of Prudential Life Insurance, KB Financial Holdings is seen as the likely candidate by the industry to acquire Prudential Life Insurance as it is highly willing to acquire Prudential Life Insurance.” said a representative for the industry. “If KB Financial Holdings acquires Prudential Life Insurance following Shinhan Financial Holdings’ acquisition of Orange Life, life insurance companies tied to financial holdings will have greater influence within the industry.”

Staff Reporter Park, Yoonho | yuno@etnews.com