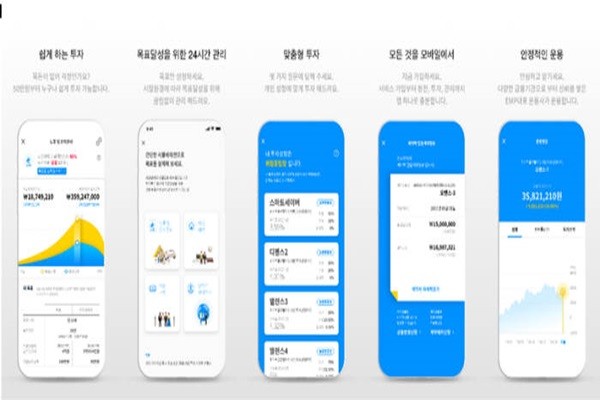

December & Company and Quarterback Investments, which specialize in robo-advisors, introduced mobile investment entrusted services on the 17th. This is the first time such service has been made available since South Korean Government allows non-face-to-face investment entrusted service in last June. This will allow small investors to easily make separate investments into any asset in the world.

According to financial investment industry, December & Company and Quarterback Investments launched mobile investment entrusted services at the same time. They are going to provide services called ‘Fint’ and ‘Quarterback’ respectively through Android-based Smartphones.

December & Company’s Fint service allows anyone to easily make separate investments into any asset in the world. Decision on investments and re-modification of assets are done automatically through an AI algorithm called ‘ISAAC’. ISAAC decides on optimal items out of global ETFs (Exchange Traded Fund) every day and automatically makes investments into them.

“Fint provides personalized portfolio service to regular investors and it is different from public offering funds and current wrap accounts.” said Vice-President Song In-sung of December & Company. “It can create many portfolios by providing operating instructions as various forms of selection options.”

Fint does not take any up-front fee, but it collects 9.5% of profits of automatically renewed contracts annually. If there is no profit, it does not take any fee.

Quarterback Investments’ Quarterback calls from a quarterback position of football that orders strategies for other positions. Basically, it will suggest investment strategies so that investors can easily manage their assets. Investors can sign entrusted contracts depending on their goals such as retirement saving and others.

One can join either global asset allocation-type ETF (domestic fund) or global asset allocation-type ETF (foreign investment). These two algorithms manage portfolios through ETFs and ETNs (Exchange Traded Note) respectively that are listed in South Korea and foreign countries.

Non-face-to-face investment entrusted services are expected to be launched by stock firms as well. KB Securities signed business agreements with December & Company and Quarterback Investments so that their services are also available within its application through open API (Application Programming Interface) method.

Korea Fintech Industry Association is also welcoming non-face-to-face investment entrusted services and it expects that innovation of FinTech industry will be much more active in the future if there continues to be regulatory innovation by financial authorities.

Staff Reporter Ryu, Geunil | ryuryu@etnews.com