It is estimated there will be about 5.8 million 5G devices in 2019. Many components industries are already looking to grab upper hands in relevant markets as they face new markets followed by LTE. It is expected that markets for modem chips will turn into competitions between many businesses when they were practically dominated by Qualcomm in the past.

A market research company called Techno System Research (TSR) is estimating that 5.8 million 5G devices will be shipped in 2019. Number of shipments will double every single year followed by 2019. Smartphones are the products that will take up the most percentage out of 5G devices. It is estimated that 90 million 5G Smartphones will be shipped in 2020 and this number corresponds to 5% of entire Smartphones that will be shipped in 2020 and it will increase to 380 million (20%) in 2022. Tablets, laptops, and VR (Virtual Reality) devices are also devices that will support 5G network.

Based on location, it is likely that biggest 5G device markets will form in the U.S., China, South Korea, and Japan. However because frequencies that can be assigned to 5G network are limited to 28GHz and 39GHz in the U.S., some predict that 5G service in the U.S. may be provided later than other three countries. China is going to expand 5G services by adding higher frequency band (4.5GHz, 26GHz) after starting with 3.5GHz. It is estimated that China will take up more than 60% of entire 5G device markets in 2022.

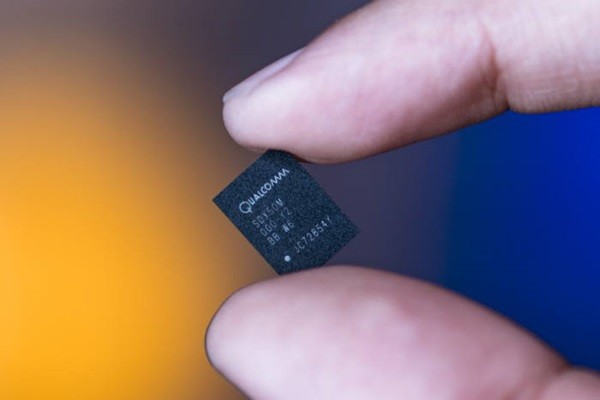

Competitions within markets for modem chips, which are core components of 5G devices, are very competitive. 5G modem chips can be divided into products that support bandwidth lower than 6GHz and millimeter wave (24 to 100GHz) and products that only support bandwidth lower than 6GHz.

Millimeter wave, which is high frequency bandwidth, has shorter range due to short wavelength of radio wave and is easier to be affected by obstacles while having fast telecommunication speed due to wide bandwidth. In order to overcome these weaknesses, entire performance of telecommunication components such as antennas needs to be improved. However, level of difficulty of this task is very high. On the other hand, because products that only support bandwidth lower than 6GHz have been used for 4G LTE services, it is relatively easy to develop them.

Unlike early days of 4G LTE when they were practically dominated by Qualcomm, many businesses are jumping into development of 5G modem chips. Qualcomm and Intel from the U.S., Samsung Electronics from South Korea, and HiSilicon from China are currently developing modem chips that support both millimeter wave and frequencies under 6GHz. Modem chips that only respond to frequencies under 6GHz are being developed by MediaTek from Taiwan, Spreadtrum from China, and ZTE’s subsidiary.

It is heard that there are many tasks such as miniaturization, low power, and better performance that need to be done for RF (Radio Frequency) antenna modules that go along with 5G modem chips. This is because these modules utilize high frequency millimeter waves that have short wavelength of radio waves. Anokiwave and Analog Device are some of the RF antenna module manufacturers.

TSR is predicting that Qualcomm’s competitive edge in chipset will be more advanced than other companies during 5G generation just like LTE generation because Qualcomm already put out designs of prototypes and references and demonstrated actual telecommunication. In case of Samsung Electronics, it is heard that it is having difficulties in developing RF antenna modules because it lacks experiences in millimeter wave field. HiSilicon’s situation is not much different from that of Samsung Electronics. TSR analyzed that HiSilicon’s development process of technologies falls behind by about a year compared to its competitors.

Staff Reporter Han, Juyeop | powerusr@etnews.com