It appears that LCD price, which had been nose-diving, has slowed down its downward trend. Some predict that LCD price will rebound at the end of this year due to increase in number of demands for LCDs as there will be increase in number of demands for TVs during end of the year sales. However forecast of LCD markets still remains unclear as many also predict that price of panel will continue to go down until end of this year.

According to a market research company called WitsView’s data on price during first half of September, average price of entire LCDs including TVs, monitors, and tablets recorded $97.6, which is 0.93% decrease from second half of August.

Average price of LCD TV panel was $187.6 and it decreased by 1.28% from August. Although there were predictions that amount of decrease will be bigger in September as average price of LCD TV panel recorded a rate of -2.37% and -2.21% in first half of August and second half of August respectively, downward trend has been reduced in first half of September compared to August.

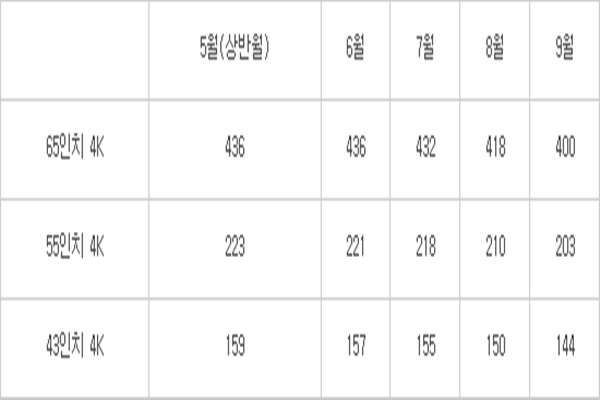

Looking at prices per sizes of major panels, average price of 64-inch 4K panel was $418 and $400 in first half of August and first half of September respectively with a rate of -4.3%. Average price of 55-inch 4K panel was reduced from $210 to $203 with a rate of -3.3%. Average price of 43-inch 4K panel was reduced from $150 to $144 with a rate of -4%.

According to industries, panel manufacturers, in order to lower financial burden from increased panel price, are either giving subsidies to TV manufacturers or carrying out strategies such as lowering market price in order to maintain a certain standard of shipments of TVs. Decrease in amount of TV shipments can bring negative effects such as oversupply due to increase in amount of panels that are in stock and faster downward trend of price on markets.

Currently predictions from industries regarding trend of LCD price are different from each other. Some expect that downward trend of panel price will slow down and rebound once again due to increase in number of demands of TVs at the end of this year from active end of the year TV promotions. On the other hand, some predict that panel price will continue to fall by end of this year as TV demands will not be brought back with Chinese market at the center.

Whether or not demands from Chinese TV manufacturers will revive again still remains unclear. Excluding Sharp and TCL, most of Chinese TV manufacturers had poor performance in this past second quarter. Sharp, which focused on targeting low-priced Chinese markets, recorded 2.52 million shipments for second quarter, which is 95.3% increase from first quarter, and jumped from 9th place to 4th place. TCL maintained its 3rd place with 21.1% increase.

On the other hand, rest of Chinese TV manufacturers had poor performance. Hisense dropped from 4th place to 6th place with -2.8%. Most of TV manufacturers that are not placed at the top of the ranking recorded minus profits. Impact on small and medium brands such as online brands was significant.

Samsung Electronics and LG Electronics, which are the top two global LCD TV manufacturers, recorded -6.9% and -3.1% growth rate of shipments in second quarter respectively compared to first quarter.

Anxiety towards oversupply of panels still remains as new LCD production lines are starting to operate. If Chinese TV demands are not brought back again, rebound of panel price throughout global LCD panel markets can be difficult.

Market research company called Sigma Intel is predicting that oversupply will continue until end of this year and that there will be a balance between supply and demand starting from second half of next year after downward trend slows down during first half of next year.

Sigma Intel is estimating that balance between supply and demand of panels will be about 6.8% due to oversupply of panels during second half of this year if it sees 5% as the balance between supply and demand. It analyzed that the balance will drop to 6.5% as both demands for TVs and supplies of panels drop during first half of next year and ultimately drop to about 5% ass there will be more demands for TVs than supplies of panels during second half of next year.

Staff Reporter Bae, Okjin | withok@etnews.com