SEMES, which is a semiconductor and display equipment manufacturer, made close to $874 million (1 trillion KRW) in sales during first half of this year. This is the first time when single South Korean equipment manufacturer made close to $874 million in sales in half of a year. Because it is making similar performance during second half of this year, it will be interesting to see if SEMES will be ranked within top 10 based on sales for the first time in 30 years since South Korean companies started making their own semiconductor equipment. SEMES has maximized opportunities from increase in facility investments due to ‘super booming of semiconductor markets’ and large investments for OLED panels.

According to industries on the 10th, sales of SEMES during first half of this year closed upon $874 million (1 trillion KRW). It is heard that its accumulated sales from January to July of this year broke its sales in 2015, when it made company’s biggest yearly sales by making $978 million (1.1189 trillion KRW). If this trend continues, it is expected that SEMES will be able to make close to $1.75 billion (2 trillion KRW) in sales this year.

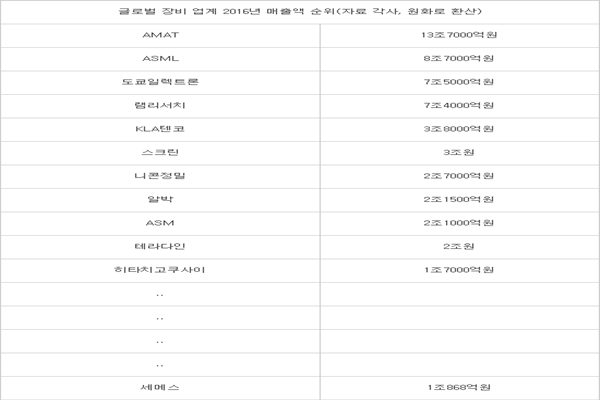

It is possible that it will be ranked within top 10 in sales along with AMAT (Applied Materials), ASML, LAM Research, Tokyo Electron (TEL), KLA-Tencor, SCREEN, Nikon Precision, ULVAC, ASM, and Teradyne.

It is heard that SEMES has shown even growth in semiconductor and display markets during first half of this year. It has shown positive trend in sales for washer and etcher for photo process and front-end and back-end equipment such as die bonder and test handler.

Its sales increased significantly as it succeeded in supplying OHT (OverHead Transport), which is a major automated equipment, to Samsung Electronics for Samsung Electronics’ 18 Line in Pyeongtaek. OHT is a system that automatically transports a tank (Front Opening Unified Pod) that is filled with semiconductor wafers. Although SEMES had been importing this system from Daifuku, it succeeded in developing its own system and made significant amount of substitution effect in profit. It is heard that SEMES supplied washer, coater for photo process, inkjet depositor to Samsung Display for extension of its A3 Line, which is a small flexible display panel production line.

“It is expected that SEMES will continue to benefit from Samsung Electronics investing tens of billions of dollars into constructing new plants in Pyeongtaek and extending its plants in Hwasung and Xi’an and Samsung Display greatly increasing amount of its investments into OLED.” said a representative for an industry.

SEMES started off as Korea DNS, which is a joint-corporation established by Samsung Electronics Dainippon SCREEN (currently SCREEN Holdings) in January of 1993. It changed its name to SEMES in 2005 and was completely incorporated as Samsung Electronics’ subsidiary when Samsung Electronics purchased 21.75% of shares that DNS had in 2010. SEMES merged with Secron and GES, which are Samsung Electronics’ other equipment subsidiaries, in 2013 and launched itself as a comprehensive equipment manufacturer that has both front-end and back-end semiconductor and display equipment. Its yearly sales surpassed $874 million (1 trillion KRW) for the first time in 2015.

Besides SEMES and SFA, South Korean semiconductor and display equipment manufacturers such as AP System, WONIK IPS, Jusung Engineering, Tera Semicon, TES, Eugene Tech, PSK, EO Technics, KC Tech, Hanmi Semiconductor, and Cymechs are likely to have either better performance this year than last year or their biggest performance this year due to super booming of memory semiconductor markets and investments for extension of OLED lines.

SFA replaced all of its previous record by making $709 million (811.4 billion KRW) just from pure equipment business excluding performance from its back-end semiconductor subsidiary called SFA Semiconductor.

Staff Reporter Han, Juyeop | powerusr@etnews.com