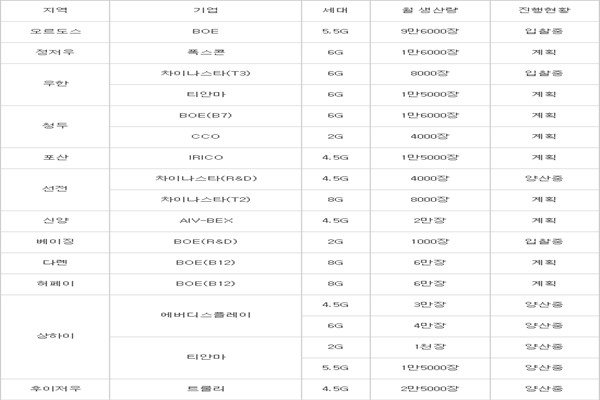

Chinese panel manufacturers are starting to make actual investments into flexible OLEDs.

Tianma and GVO have started to order equipment to prepare production lines for flexible OLEDs. It seems that BOE and CSOT are going to postpone their initially planned investments into 8th generation LCDs and invest into flexible OLEDs by end of this year. Chinese businesses, which are practically skipping over ‘rigid OLED’ and going straight to ‘flexile OLED’, are aggressively going after South Korean businesses.

Although Tianma planned to extend facilities for 6th generation LTPS (Low-Temperature Poly-Silicon) LCDs in Wuhan, it has decided to convert them for flexible AMOLEDs. Tianma invested total of $1.78 billion (12 billion yuan) during first half of last year for these facilities. Tianma is planning to use some of these facilities for producing LTPS-based AMOLEDs and mass-produce them starting from second half of next year.

GVO (GoVisionox) is investing $673 million (4.53 billion yuan) to extend 6th generation LTPS-based AMOLED facilities that are located in Kunshan. It is speeding up in expanding its AMOLED business as it confirms on 2nd stage of investment followed by 1st stage that took place early this year.

GVO is a joint-corporation that was established by Visionox with help from Chinese Government to mass-produce small and medium-sized OLEDs. It is heard that GVO is also looking to prepare additional 6th generation AMOLED facilities in Chengdu during second half of this year.

CSOT is almost finished with carrying out investments for 6th generation LTPS-based LCD and AMOLED facilities in Wuhan. Although it initially decided to make 2nd stage of 8.5th generation facilities that are located in Shenzhen into LCDs, it has decided to go with metal oxide-based flexible OLEDs and AMOLEDs and is currently ordering equipment. Expectations from industries are increasing because it is heard that CSOT is going to decide on new investments for flexible OLEDs at the end of this year.

BOE has started making investments into B7 line, which is a production line located in Chengdu to produce flexible OLEDs. This line will secure capability to produce 45,000 per month by 2019 and amount of investments is about $3.76 billion (24.5 billion yuan). Industries are predicting that BOE will carry out this investment by going through two stages of investments.

Industries are also highly interested on ‘B11 (presumpted name)’, which might be used to produce flexible OLEDs rather than 8th generation LCDs, and they believe that BOE will make a decision very soon. Additional investments for 5.5th generation AMOLEDs from 5.5th generation ‘B6’ line, which is located in Ordos, are also drawing attentions.

Although Chinese manufacturers are mass-producing small amount of small and rigid OLED panels, this does not cause threat to Samsung Display, which is the top business in the world in yield and supply amount.

According to information from a market research company called IHS, Samsung Display took over 97.7% from global OLED markets during first quarter of this year based on shipments. 2nd and 3rd places were LG Display (0.9%) and Taiwan’s AUO (0.7%) respectively.

Flexible OLEDs require more expensive facility investments than rigid OLEDs and their level of difficulty in technology is very high. Due to these facts, South Korean panel industries are interested how actual yield and quality of panels are going to be if Chinese panel manufacturers, which do not have stable yield of rigid OLEDs, go straight to making investments on flexible OLEDs.

“Even if excellent equipment and materials are used, good results can only come out production lines if panel manufacturers have their distinct technical skills.” said a representative for a South Korean industry. “Although it is threatening that China is speeding up its investments towards flexible OLEDs, we need to see actual outcomes first.”

Staff Reporter Bae, Okjin | withok@etnews.com