SK Innovation is planning to increase production capability for LiBS (Lithium Battery Separator), which is a major component of a secondary battery, by 50%. Based on yearly standard, it is going to be increased by 120 million m2. Its ultimate goal is to defeat Japan’s Asahi-Kasei by 2020 and become the top business in this market globally.

SK Innovation made an announcement on the 28th that it is going to construct extra 2 lines (number 10 and 11) to its LiBS production facility that is located in Jeungpyeong, Chungbook. It is planning to start construction next month and finish it by first half of 2018. When construction is finished, production capability will be increased to 330 million m2, which is an amount that is equivalent to 1 million batteries for BEVs (Battery Electric Vehicle).

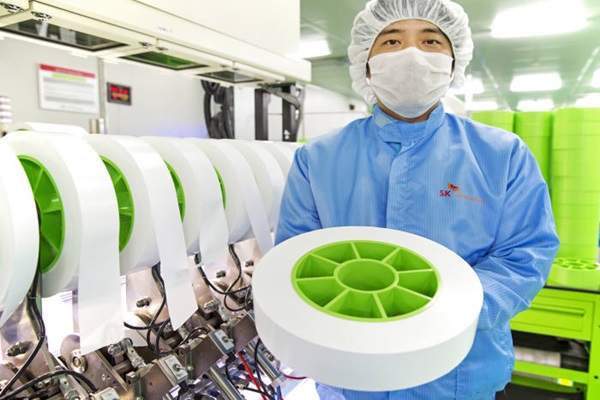

LiBS, which is used for batteries of electric vehicles and Smartphones, is a highly-polymerized thin film with a thickness of hundreds of micrometer (millionth of a meter). It is located between cathode and anode of a battery and is a major component that affects safety and performance of a battery by preventing unusual movements such as explosion and ignition.

SK Innovation’s goal is to narrow its gap with Asahi-Kasei. LiBS can be divided into dry LiBS and wet LiBS depending on a manufacturing method. Although manufacturing cost of wet LiBS is high, its quality and strength are excellent. Currently 70% of global LiBS markets are wet LiBS and 26% of 70% were owned by SK Innovation last year, which made it number 2 business in wet LiBS market. There is only about 5% difference between SK Innovation and Asahi-Kasei, which is the top business in this market. SK Innovation’s plan is to secure the top position in wet LiBS market by 2020 through continuous investments.

As Asahi-Kasei bought Celgard (dry LiBS), which was number 3 business in dry LiBS market, last year, difference in shares between Asahi-Kasei and SK Innovation in all wet and dry LiBS markets is more than 20%. However because it is expected that SK Innovation will be able to secure more than 20% in global demands through this extension, it is predicted that gap between SK Innovation and Asahi-Kasei will become narrower.

A market research company called B3 is estimating that LiBS market will rapidly grow at a rate about 17% per year until 2020. It is estimating that demands for IT devices and demands for LiBS for medium and large-sized batteries for electric vehicles will grow annually at 9% and 29% respectively. It is estimated that value of market will grow from $612 million (700 billion KRW) in 2010 to $2.62 billion (3 trillion KRW) in 2020.

SK Innovation became South Korea’s first and world’s third business to succeed in developing LiBS in 2004 and it started its first production at its number 1 line, which is located in Cheongju, Chungbook, in January of 2005. It was able to start making surplus in just two years and had continued its positive trend until last year. Its accumulated sales surpassed $877 million (1 trillion KRW). One out of five laptops and cellphones that are produced globally uses a lithium-ion secondary battery that has SK Innovation’s LiBS.

Staff Reporter Choi, Ho | snoop@etnews.com