After turning the corner by getting approval to merge Samsung C&T and Cheil Industries, there is now a possibility that Samsung is going to establish holding field by creating spin-off from Samsung Electronics and push for a merger of Samsung C&T and holding field.

HI Investment & Securities examined on the 20th a direction of reorganization of Samsung Group’s full-scale management structure by examining scenarios after the merger.

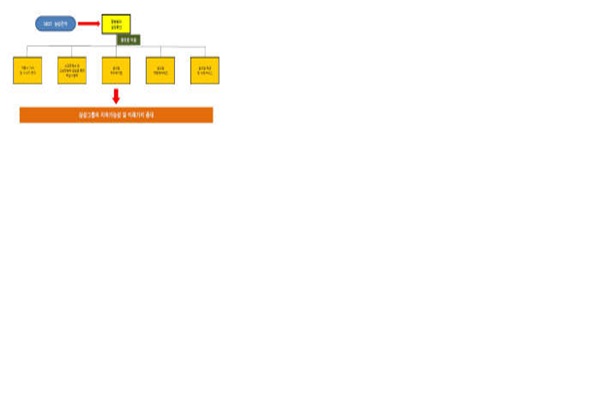

Main point of this scenario is that Samsung Electronics will establish a corporate body for holding field through spin-off and merge it with combined corporate body of Samsung C&T and Cheil Industries.

After spin-off from Samsung Electronics takes place and combined Samsung C&T and Samsung Electronics’ holding field merge, the merger will secure most of company’s stakes including stakes from Samsung Electronics’ business company. If this happens, combined Samsung C&T will become group’s holding company and it will become the biggest beneficiary due to increase of dividend income and loyalty from brand.

“By being Samsung Group’s holding company, combined Samsung C&T will secure subsidiaries such as Samsung Electronics’ stakes. It will focus on stabilizing business control and developing new growth engine for new businesses that will bring sales and profits to Samsung Electronics for the next 30 years.” Researcher Lee Sang Hun of HI Investment & Securities said that combined Samsung C&T will play a big role in Samsung Group’s future.

He also said that even though next step for combined Samsung C&T to take is to secure most of Samsung Electronics’ stakes, it will have a hard time because market capitalization of Samsung Electronics is too big. He also predicted that next scenario that will happen hereafter is a spin-off from Samsung Electronics.

HI Investment & Securities is predicting that there is a greater possibility of Samsung SDS merging with Samsung Electronics’ holding field or combined Samsung C&T than with Samsung Electronics. Although Samsung C&T’s and Vice-Chairman Lee Jae Yong’s stakes in Samsung Electronics will increase if Samsung SDS and Samsung Electronics merge, in contrast to insignificant level of increase, its growth cannot stick out because it will be included as the others of Samsung Electronics if level of sales is considered from business perspective level. If combined Samsung C&T merge with Samsung SDS, subsidiary companies will form vertical integration and its growth as a holding company can stand out.

HI Investment & Securities is seeing that it is possible for Samsung C&T and Samsung Electronics’ holding field to merge and merger and stock holding related to Samsung SDS are all possible.

Samsung SDS will perform a role of software that is Samsung Group’s new growth engine hereafter and it is expecting strengthened business in bio department. If Samsung C&T merge with Samsung Electronics’ holding field, its stake in Samsung Biologics will be up to 97.5%. Samsung C&T’s bio field can be emerged as Samsung Group’s next-generation business through listing of NASDAQ.

Staff Reporter Kim, Seungkyu | seung@etnews.com