Supply versus demand 'manpower training' is a task

Software (SW) testing industry sales increased significantly. Overseas expansion also increased significantly. It is evidence that digital transformation (DT) is accelerating in all fields of industry, and the demand for software testing has also increased, which is essential for securing quality (performance) and safety. On the other hand, the supply of manpower did not keep up with the increased demand, so manpower training emerged as a challenge.

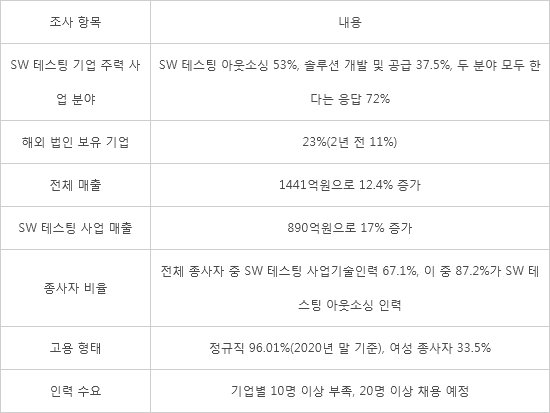

At the 'Better Software Testing Conference 2021' hosted by the Korea Software Testing Association, Electronic Times Internet, and the Korea Software Industry Association, Dongguk University Professor Jin-ho Park reviewed the results of the 'Domestic Software Testing Industry Status and Status Survey' conducted with about 30 members of the Korea Software Testing Association on the 15th. According to the survey, companies picked SW testing outsourcing as their main business model was 53% and SW testing solution (tool) development and supply was 37.5%, respectively. 72% of the respondents answered that they did in both fields, and it was analyzed that not only simple testing but also solution development to increase reliability was active.

The number of companies with overseas subsidiaries increased from 11% two years ago to 23% this year. The countries where overseas subsidiaries are located include the United States, China, Japan, India, Australia, Singapore, and Vietnam. It is interpreted that the number of companies establishing local subsidiaries to supply testing personnel to overseas subsidiaries of manufacturers such as Samsung Electronics has increased.

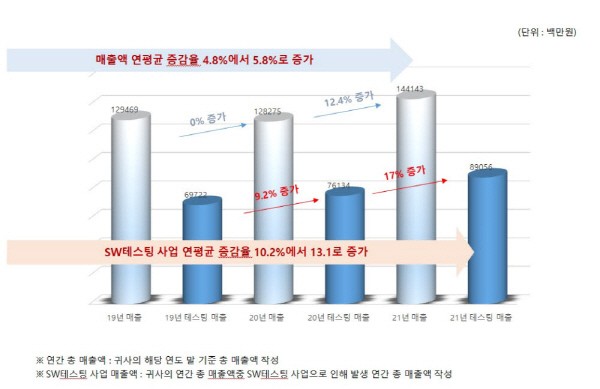

Sales of all software testing companies slowed down for a while in the aftermath of COVID-19 last year. This year, it was about 144.1 billion KRW, an increase of 12.4%. The testing business sales of these companies increased 17% from 76 billion KRW last year to 89 billion KRW this year. It is growing at an average annual growth rate of 13%.

Among all employees of software testing companies, the number of software testing business technical personnel is 67.1%, which is increasing every year. Among the SW testing businesses, the outsourcing workforce accounted for the most at 87.2%. It was followed by solution development and supply personnel with 8.1% and education and consulting personnel with 3.7%, respectively.

Another thing to note is the type of employment. The number of full-time employees in SW testing companies increased from 95.99% at the end of 2019 to 96.01% at the end of 2020. This is a higher level of regular workers than in other industries. It is also noteworthy that the proportion of female workers increased from 25.2% to 33.5% during the same period. Although the demand for SW testing manpower increased, manpower recruitment (supply) did not keep up. On average, companies responded that more than 10 people were needed for their SW testing and they said they plan to hire more than 20 people.

Professor Jin-ho Park said, “Companies with the SW Testing Association hired 700 to 800 people three years ago, but they said they would hire more than 1,000 people this year. Nevertheless, there is a shortage of professional manpower at the manager level, so even if a business proposal comes from a customer, it cannot be accepted.” Professor Park addressed “Continuing education and training of manpower is necessary in relation to SW testing.”

<Table> Main contents of 'Domestic SW Testing Industry Status and Survey'

By Staff Reporter Ho-cheon An (hcan@etnews.com)