Multinational companies such as Microsoft (MS), Facebook, and Google are constructing data centers all over the world due to rapid increase in demands for cloud computing services and analysis of large amount of data to implement AI (Artificial Intelligence). There is also an increase in demands for large-scale data centers that are at the level of hyperscale. As a result, companies such as Equinix and Digital Realty that specialize in data center are growing as well.

South Korea is emerging as a major data center market for multinational companies and it is also seen as a key position to target surrounding countries. South Korean companies are busy with constructing new data centers to provide data centers or space for data centers to foreign companies.

◊Multinational companies focus on constructing data centers around the world

MS, which has recently emerged as an up-and-coming powerhouse within the cloud industry, is busy with constructing data centers to respond to demands for cloud computing service. By the end of the first half of 2019, MS had 55 data center regions (multiple data centers) in the world. Because there are increased demands for cloud computing service from all over the world, MS has data centers distributed evenly throughout the world. It has 18 regions in the U.S., which is the biggest market for the cloud industry, alone and it has 20 and 17 regions in the Middle East and Europe and Asia respectively. It is currently planning to construct one and eight regions additionally in the U.S. and EU respectively.

Facebook has also been busy with expanding its data centers globally. It currently has 15 regions in the world and it has 11 regions in the U.S. alone. It has three and one region in EU and Asia respectively. It is currently working on expanding the size of six data centers and two data centers from the U.S. and EU respectively. It is also busy with constructing new data centers as it is planning to construct six additional regions in the U.S. and one additional region in both EU and Asia.

Other multinational companies such as Amazon, Alibaba, and IBM are also continuing to expand their data centers and construct new data centers. Amazon recently invested $118 million (140 billion KRW) to purchase a land in Virginia to construct new data centers. It already has at least 30 data centers in Virginia alone. It is likely that Virginia will become a key position for Amazon regarding data center.

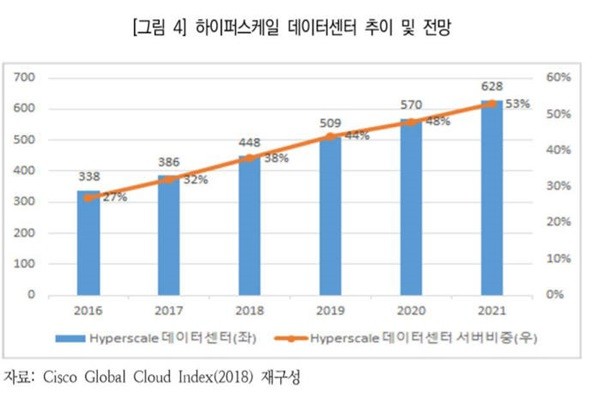

As there is an increase in demands for data centers for cloud computing service and AI, there is also an increase in number of hyperscale data centers.

According to Cisco, amount of workload for cloud computing out of the amount of workload within a data center is increasing gradually. In 2012, percentage of amount of workload for cloud computing compared to the total amount of workload within a data center was only 39%. However, it is estimated that the percentage will rapidly increase to 94% in 2021.

As a result, number of hyperscale data centers in 2017 was 386, which is 14.2% higher than the number of hyperscale data centers in 2016. The number increased to 448 and it is estimated that the number will be 628 in 2021 which will be 10.17% higher than the number of hyperscale data centers in 2020. MS and Amazon are also working on expanding their data centers and have them become hyperscale data centers while constructing new data centers at the same time.

◊South Korea emerges as a new data center market

As multinational companies are constructing or extending their data centers in key countries, South Korea is also seen as a key country for them. Major cloud computing service providers such as MS and AWS (Amazon Web Service) already constructed their data centers in South Korea three years ago. Major multinational internet companies such as Google and Facebook are also looking to construct their data centers in South Korea.

Reason why South Korea is mentioned as an important data center market is because it has many industrial and geographical advantages. South Korea has recently emerged as a new cloud market followed by the U.S. and Europe. It is expected that demands for cloud computing service will only get bigger as the amount of data use will continue to increase as 5G network generation becomes a norm. Geographically, South Korea is also a strategic base in Asia followed by Singapore. Some say that it is more stable to construct data centers in South Korea rather than Japan that can be unstable due to natural disasters. Cheaper electricity bill compared to other countries and active moves by local governments to attract foreign companies are also elements that raise the level of appeal of South Korea.

As South Korea has emerged as a rising data center market, South Korean and foreign data center-specializing companies are taking necessary actions. Multinational companies that only specialize in data center entered the South Korean market one after the other. After Equinix and Digital Realty entered the South Korean market, they started renting out their data centers and hinted about a possibility that they would construct data centers by acquiring lands. South Korean companies are also constructing data centers to rent out data centers to global companies. Major companies such as Samsung SDS and Shinsegae I&C are set to operate their new data centers soon. They are expected to use their data centers for their own groups as well as global companies. It is expected that there will be more collaboration between multinational companies and South Korean companies as Equinix rented Samsung SDS’ data center in Sangam-dong.

“Fact that Equinix and other data center-specializing companies entered South Korean market alone indicates that South Korea’s data center market is growing.” said a representative for Korea Data Center Council. “As data center has become an important industry for other major industries such as 5G and AI, there needs to be systematic government support to promote and to support data center industry in South Korea.”

Staff Reporter Kim, Jiseon | river@etnews.com