Predicting 20% share of DDR5 at the end of the year... Overtaking DDR4

Gaining attention of ‘winning move’ to overcome the memory market slump

It is expected that demand for DDR5 memory, a new DRAM standard, to increase in earnest as Intel releases '4th Gen Xeon Scalable (Code Name: Sapphire Rapids)', a next-generation server central processing unit (CPU). There are predictions that DDR5 will account for 20% of all DRAM in the second half of this year. Attention is focused on whether Intel server CPU will become a new winning move to overcome the slump in the memory market.

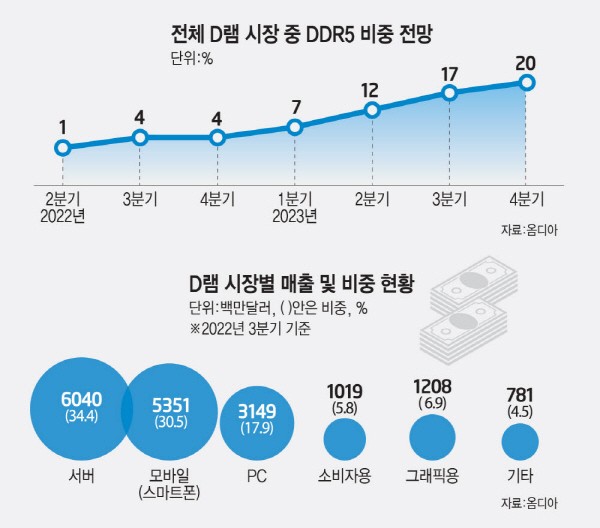

According to market research firm Omdia, DDR5 DRAM is expected to account for 7% of all DRAM in the first quarter of this year. The market share of DRAM, which stood at a maximum of 4% per quarter until last year, is expected to rise in earnest. In the fourth quarter, it is expected to rise sharply to 20%, surpassing the existing DDR4 (12%).

This rise is analyzed to be due to the fact that Intel, which preoccupied the server market, released the first DDR5-supporting CPU. According to Mercury Research, Intel boasts an overwhelming share of around 90% in the global server CPU market. This means that the secondary server memory market can be influenced by the Intel CPU support specifications. Until now, CPUs released by Intel only supported up to DDR4. DDR5 DRAM for servers was limited in market supply because there were no CPUs that supported it. It is known that it was used only for research and development (R&D) by some research institutes or universities.

The launch of Sapphire Rapids is expected to create server replacement demand from data center companies. As amount of data processing continues to increase, it is predicted that attempts to rebuild information technology (IT) infrastructure based on high-performance and low-power CPU will begin in earnest.

As the server DDR5 market blooms, attention is paid to whether it will revitalize the stagnant memory market. Since DDR5 is more expensive than DDR4, memory manufacturers’ profits may gain momentum. TrendForce recently predicted that the price of DDR5 memory would drop by around 20%, but there is also a prospect that the price drop will help spread DDR5. This is because it can accelerate the server replacement demand of some data center companies, which have been reluctant to invest in facilities due to high cost.

Changes in the memory market due to DDR5 are also expected. Due to the contraction of the front industry, the share of smartphone(mobile) and PC-use memory continues to decrease, while server-use memory continues to grow. According to Omdia, DRAM for servers surpassed DRAM for smartphones for the first time in the third quarter of 2021. As of the third quarter of last year, the gap between server-use (34.4%) and smartphone-use DRAM widened to 4% points (P). This gap is expected to continue this year as well.

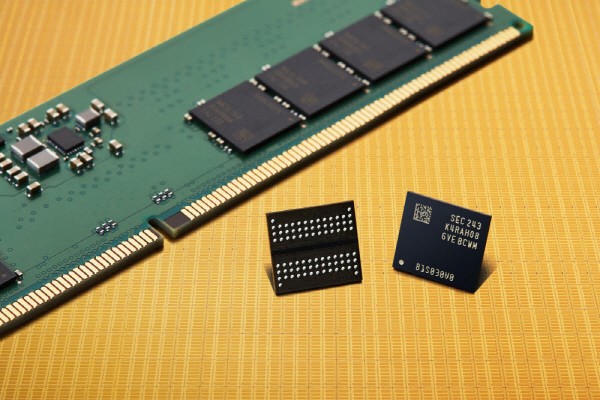

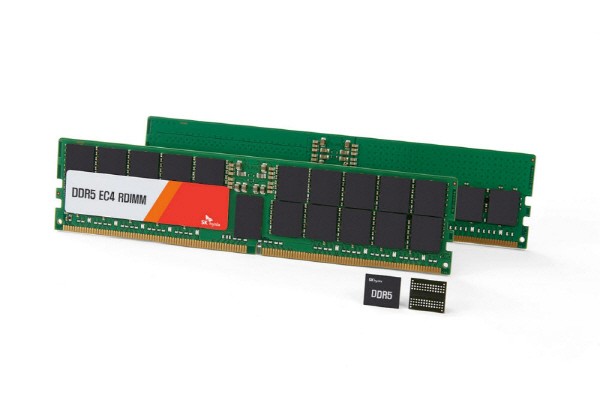

Fierce competition among major memory manufacturers in the server market is inevitable. Samsung Electronics, SK hynix, and Micron have all released DDR5 DRAM. An industry insider said, "Differentiated memory performance and cooperation with data center companies will be a competitiveness to preoccupy the DDR5 DRAM market."

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)