Slowdown of core demand for Mobile·Server·PC

Reducing facility investment... Initiate inventory adjustment

'Growth' expected for automotive·foundry

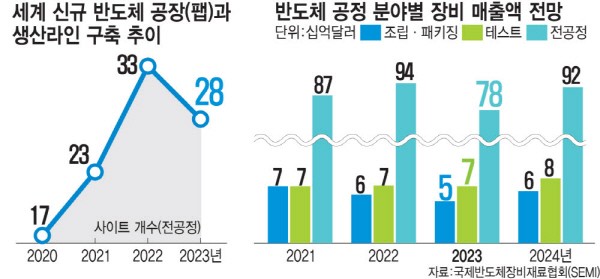

It seems it is inevitable to avoid the recession of semiconductor in the new year. As consumer sentiment sharply shrinks due to the global economic downturn, the downturn in the semiconductor front industry continues. It is difficult to expect high growth rates for both memory and system semiconductors. Due to the reduction in facility investment, the materials, parts, and equipment industry must overcome the 'Barley Hump'. A rebound of market is expected only after the second half of next year. Experts agreed that as fierce competition is expected after the market recovery, companies should focus on strengthening their R&D capabilities.

◇Degrowth of semiconductor market... Direct hit on memory sector

A market research firm predicted that the semiconductor market would degrow in 2023. Compared to this year, Gartner predicted that the semiconductor market would shrink by 3.6%, and the World Semiconductor Trade Statistics (WSTS) by 4.1%. The core demand for semiconductors is mobile (smartphone), server, PC, and home appliances. Consumers are closing their wallets due to the Russia-Ukraine war, the US-China trade conflict, and high inflation. The replacement cycle for smartphones will be slightly better than this year, but PC and home appliances are not expected to see much new demand. With the rapid increase in data throughput, the server market has grown into a key front industry for semiconductors.

As major data center companies are hesitant to invest due to the economic downturn, facility investment is expected to be postponed or reduced until the first and second quarters. The growth rate of server shipments in 2023 predicted by TrendForce in October was 3.7%, lower than this year (5.1%). TrendForce predicted a downturn in the server market by lowering it to 2.8% growth in one month. While memory-oriented Korean semiconductor companies were hit hard, it is known that the current inventory of DRAM and NAND flash is between 14 and 17 weeks. This is expected to lead to lower memory prices. Shrinking earnings and consequent reduction in investment are inevitable. In the semiconductor equipment industry, product order cancellations and delays are already occurring one after another.

◇ Even system semiconductors·packaging have downward trend

The system semiconductor market, which has continued to grow, is also showing signs of downturn. In the third quarter of this year, the world's top 10 semiconductor fabless (design company) sales decreased by 5.3% compared to the previous quarter. The fourth quarter and the first quarter of the following year are peak season for smartphones, PC, and home appliances, which are key sources of demand for system semiconductors, but demand growth is expected to be insignificant due to continuous inflation. It seems that system semiconductors will also be unable to avoid the inventory adjustment period.

Due to the limited growth of system semiconductors, there are concerns about chain reduction in the packaging market as well. Global Outsourced Semiconductor Assembly and Test (OSAT) companies have already announced a reduction in facility investment next year. Profits are expected to degrow further as many domestic OSAT companies focus on memory packaging. An OSAT company official said, “The limitations of the memory-centered domestic back-end process industry structure are clearly being revealed. We are trying to increase the proportion of the system semiconductor business.”

◇ ‘Hope’ in automotive semiconductor·foundry

With the electrification of automobiles and the expansion of the EV market, the automotive semiconductor market is expected to 'Grow alone'. Next year, new car sales are expected to increase by up to 4.7% from this year to 81.7 million to 85.3 million units. As the penetration rate of EV increases, the installation of semiconductors for vehicles is also leading the usage of semiconductor. Factory (fab) investment of major foundry companies is also playing a role of welcome rain in the drought. Samsung Electronics, TSMC, Intel, and others are proceeding with the construction of fabs with the goal of operating them in 2024~2025. It is expected that orders for major materials, parts and equipment will begin in the first half of next year at the earliest. Some materials and parts companies that require upfront investment have already started responding. Hong-joo Baek, CEO of Wonik QnC, said, “We expect the demand for semiconductor materials·parts to increase exponentially around 2024. If we do not make equipment investment in the earnest, it will not be easy to respond in the future.” However, it is also analyzed that it would difficult to return large benefits to the domestic equipment industry, which has a low share of the foundry market. The top four global companies, Applied Materials, ASML, Lam Research, and TEL, account for 70% of the foundry equipment market.

The third or fourth quarter of next year will be the turnaround time. As the launch of Intel's new server central processing unit (CPU) is announced early next year, new demand for DDR5 DRAM is expected. Considering time such as data center verification work, sales are expected to start in earnest in the second half of the next year. If consumer sentiment revives with China's COVID-19 mitigation policy, it is highly likely that the recovery of downstream industries in the Chinese market will lead the growth of the semiconductor market. Jae-geun, Park, Chairman of the Korean Society of Semiconductor & Display Technology, said, “In a recession of semiconductor markets, facility investment decreases, but R&D investment continues. When booming period comes, company will seize the opportunity to gain a competitive edge. It's time for business strategies and government policy to focus on R&D investment and support.”

[Market Forecast in Short]

△“It is a harsh winter. It looks like it will be difficult until next year. The supply chain has been strained due to the Russia-Ukraine war, and this needs to be resolved. Next year, when the atmosphere of inflation and high interest rates eases, the problem with the supply chain of semiconductor materials, parts and equipment will be also resolved, and demand is likely to rise to some extent. In difficult times, we need to increase our R&D investment and develop our stamina.”- Chang-Han Lee, Vice Chairman of the Korea Semiconductor Industry Association-

△ “There is a high possibility that the recession will continue until the second quarter, and then possibility of an upturn from the third quarter. During that period, investment in semiconductor manufacturers will be reduced, so materials, parts and equipment companies will have problems. In particular, when equipment sales decline, profits decline, making it difficult to make new investments. However, R&D investment, which will be the future game, should not be missed. The role of the government is also needed here.”- Jae-geun Park, Chairman of the Korean Society of Semiconductor & Display Technology (Professor, Hanyang University)-

△ “Semiconductor packaging will thoroughly match the information and communication technology (ICT) industry trends. For semiconductors mounted on smartphones or PC, it is difficult to expect an increase in package volume for either memory or system semiconductors. There seems to be no change in the package form. The volume of semiconductor packages for data and EV is expected to continue to increase. Differentiated packages and technologies such as thermal characteristics will continue to develop.”-Sa-yoon Kang, President of The Korean Microelectronics and Packaging Society -

△ “The system semiconductor market is also quite difficult. New demand must be discovered at the public and private level. In the case of artificial intelligence (AI) semiconductors, which are expected to grow in the market, most of them use foreign products, and domestic companies have limitations. As the semiconductor recession is expected, we must drive the growth of our companies by discovering domestic demand.”-Hyuk-jae Lee, Director of the System-IC Industry Promotion Center from Seoul National University (Professor of Electrical and Information Engineering, Seoul National University)

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)