There is a forecast that the automotive semiconductor market will nearly double in size compared to last year in five years. This forecast is based on the number of semiconductors installed in vehicles increases as the speed of vehicle electrification accelerates and spread of EV. It is expected that the growth of processors that control various functions of automobiles and memory that stores data will be steep.

According to Yole Intelligence, market research firm, the automotive semiconductor market in 2027 is expected to grow at an average annual rate of 11.1%, reaching 80.7 billion USD (approximately 105 trillion KRW). Compared to last year's market size of 44 billion USD, it would nearly be doubled. The number of semiconductor chips installed in automobiles is expected to increase from around 820 to around 1,100 in 5 years. The price of a semiconductor chip for a car is also expected to rise from the current 550 USD to 912 USD.

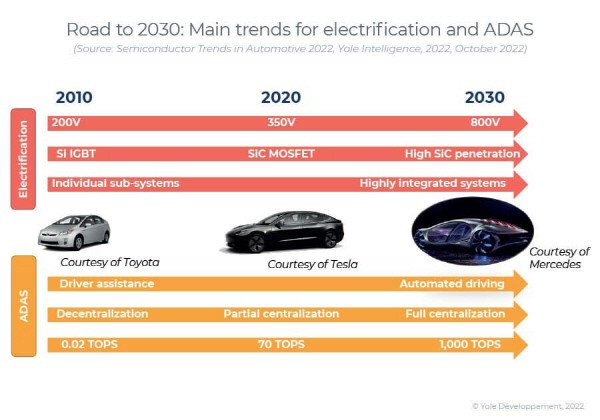

The growth of automotive semiconductors is due to spread of EV and as semiconductors is a key element in vehicle operation. Also, demand for semiconductors has increased as rapid electrification has taken place in existing internal combustion engine vehicles. The use of semiconductors is increasing for advanced functions such as infotainment as well as vehicle control. In addition, as data processing such as autonomous driving increases, the demand for memory to store data also increases.

In semiconductor item, power semiconductors account for the largest share. Currently, more than 31% of all automotive semiconductors are power semiconductors which is more than 13.8 billion USD. By 2027, the power semiconductor market is also expected to account for the largest market share at 21.1 billion USD. Although silicon-based power semiconductors are the dominant, the growth of compound semiconductors such as silicon carbide (SiC) is expected to be very steep. The production of SiC semiconductor wafers for vehicles in 2027 will be around 1.13 million sheets, which is less than that of silicon (30.5 million sheets), but Yole Intelligence analyzes that the growth rate is greater than other compound semiconductors such as gallium arsenide (GaAS).

Memory semiconductors showed the steepest growth over the past five years. With an average annual growth rate of 23.7%, it ranks first among automotive semiconductor items in terms of growth rate alone. Due to growth of autonomous driving system demands, the amount of DRAM required in levels 4~5 is expected to increase significantly. The size of the automotive memory semiconductor market in 2027 would be 13.7 billion USD, the second largest after power semiconductors. Currently, the share of automotive semiconductors in the DRAM market is insignificant, but it is highly likely to emerge as a major market along with servers, mobiles, and PC in the future. The processor market is also expected to grow rapidly at an average annual rate of 17.2%.

Yole Intelligence predicted that along with the growth of the semiconductor market, the vertical integration of the material and parts supply chain of finished car makers would accelerate. It is expected that joint ventures, mergers and acquisitions (M&A), and investment/sales will be actively carried out to gain a competitiveness. Yole Intelligence said, “Automotive original equipment manufacturers (OEM) will need to negotiate directly with semiconductor chip manufacturers and change supply chain management to maintain buffer inventories. They need to work closely with chip manufacturers on quantitative forecasting and long-term orders.”

Automotive Semiconductor Market Size Forecast by Item

Unit: Hundred million USD, Source: Yole Intelligence

By Staff Reporter Dong-jun Kwon (djkwon@etnews.com)