The global NAND memory market in the third quarter decreased by 24.3% compared to the previous quarter. Only KIOXIA from Japan maintained same level from the second quarter while sales of major NAND companies fell by more than 20%. Despite NAND makers’ production adjustments, fourth quarter sales are expected to drop by nearly 20%.

Market research firm TrendForce announced on the 24th that the total sales of the NAND flash industry in the third quarter recorded 13.11 billion USD (approximately 17.54 trillion KRW). The sales shrunk by 24.3% compared to the previous quarter.

TrendForce pointed out a drop in price due to a sharp drop in demand as the cause. As shipments of products such as home appliances and servers fell below expectations, the overall NAND average selling price (ASP) fell by 18.3%. The shipments of bit from NAND makers also declined by 6.7%.

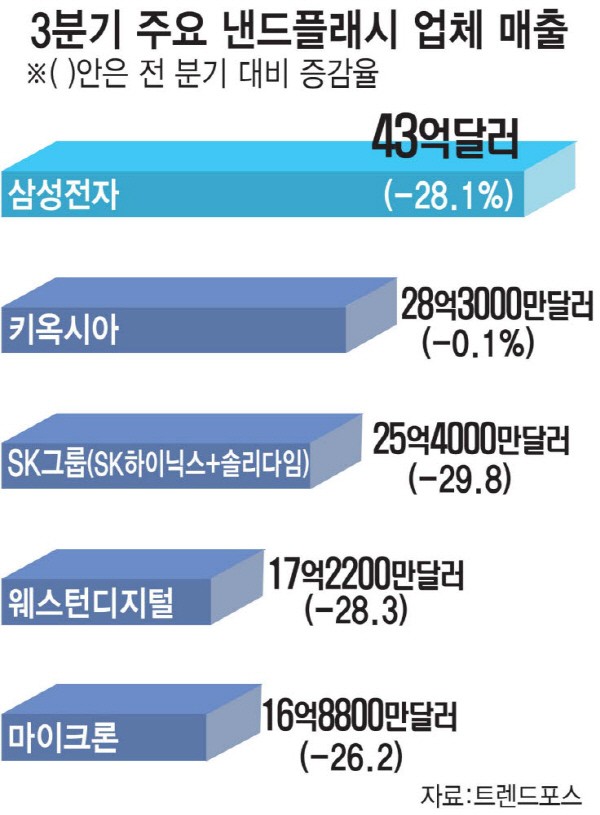

By company, SK hynix and their subsidiary Solidigm showed the largest decrease. The combined sales of the two companies in the third quarter was 2.54 billion USD (approx. 3.39 trillion KRW) which is 29.8% decrease. Demand for PCs and smartphones were also affected by corporate inventory depletion and decreased as well as servers, which relatively had stable demand. Due to a sharp drop in demand, the combined sales ranking of the two companies in the third quarter dropped to the third place.

The second place was occupied by KIOXIA. KIOXIA’s sales in the third quarter were 2.83 billion USD (approx. 3.78 trillion KRW), which was only 0.1% decrease from the previous quarter. TrendForce analyzed that KIOXIA returned to second place after recovering from a material contamination accident that occurred earlier this year. Although demand for home appliances was weak, bit shipments increased by 23.5% as supply expanded mainly from smartphone customers.

Samsung Electronics maintained their number one position in the third quarter with 4.3 billion USD (approx. 5.74 trillion KRW), but their sales decreased by 28.1%. This was largely attributable to a decrease in shipments of solid-state drives (SSD) for enterprise due to slowing server demand. Western Digital and Micron ranked fourth and fifth, with sales down 28.3% and 26.2%, respectively.

TrendForce predicted that sales in the NAND industry would decline in the fourth quarter as well. It is analyzed that pressure of inventory depletion will continue to increase and the NAND industry's production cuts will not immediately lead to an effect. Previously, NAND flash makers, excluding Samsung Electronics, announced their plans to cut production significantly. TrendForce expects NAND prices to decline by 20-25% and overall sales to decrease by nearly 20% in the fourth quarter.

By Staff Reporter Yoon-sub Song (sys@etnews.com)