Applies to only 3.3% of domestic SW companies

Local regulations and culture are biggest obstacles

Goverment says, “will work to vitalize SaaS and exports”

There were 932 software (SW) companies that expanded overseas last year, a 21.8% rise compared to 765 SW companies that had overseas expansions in 2020.

However, 932 is only 3.3% of a total 28,242 SW companies. It had been pointed out that SW companies need to improve their competitiveness not only in the Korean market, but in overseas markets as well, in order to achieve the government task of ‘A Qualitative Leap in the Software Industry’.

◇ SW companies expanding overseas reaches 3%... 170 more than the previous year

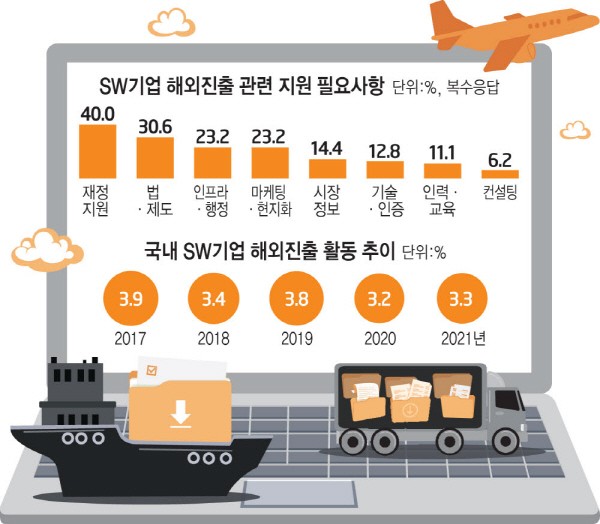

According to a report on the state of the SW industry, the number of SW companies that had overseas activities in 2021 totaled to be 3.3% of all SW companies. This is an increase of 170 companies compared to the previous year. By industry, game SW companies had the highest percentage of overseas expansions (13.3%). Next in order were SW packages (3.1%), IT services (1.9%), and internet SW (1.3%).

Overseas ‘export’ companies are 2.9%. From the companies with overseas activities, export companies which have actual overseas sales (exports) reach 87.6%, and the total of potential export companies with no overseas sales make up 12.4%.

The method of overseas expansion with the highest proportion was product-only expansion with 60.7%, and following that were online service, cloud service, and app market at 18.9%, connecting to local companies at 15.2%, and connecting to SW in similar fields at 11.9%. While online service, cloud service, and app markets had a slight decrease in proportion, product-only expansion, connecting to SW in similar fields, and connecting to local businesses increased in proportion.

The SW categories that potential export companies are preparing for overseas expansion had the highest proportions in portal and internet information medium services (20.3%) and application SW (16.0%).

◇ Difficulty with local regulations and policies overseas… need government support in finance, laws, policies

Companies that have overseas activities are facing difficulties with the differences in regulations, policies, and culture in local countries. Surveys have shown that the biggest difficulties that companies with overseas activities are facing are differences in regulations, policies, and culture (verification and contracts) (30.4%), lack of market and client information (21.9%), and responding to local requests (development and testing application, etc) (15.2%).

There was a comparatively high number of responses from potential export companies indicating difficulties with differences in regulations, policies, and culture in local companies (verification and conctracts) (29.4%).

The areas that companies with overseas activities needed the most government support were in the order of financial support (40.0%), law and policy (30.6%), and infrastructure and administration (23.2%).

To help SW overseas expansion, the government is supporting △SW high growth club △Big, medium, small joint overseas expansion △application programming interface (API) marketplace, etc. In addition to this, they are preparing to distribute guidelines for the strategic SW supplies export permit system and measures to improve regulations.

Min-young Cho, the head of the SW industry at the Ministry of Science and ICT, said that, “We are working on improving regulations that are currently obstacles for exporting SW, and are expanding support for R&D to improve the global technical competitiveness of SW companies,” and went on to say, “We will work hard to facilitate the overseas expansion of SW package companies, and SaaS companies in particular.”

By Staff Reporter Hye-mi Kwon (hyeming@etnews.com)