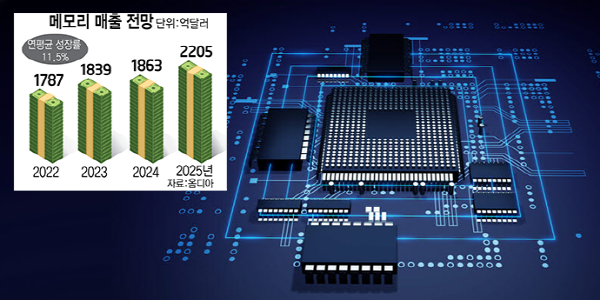

The memory industry, which is currently facing a downturn, is predicted to recover in the latter half of next year. With the issue of oversupply, especially around DRAM, being solved, it has been evaluated that the industry will continue to grow in the long term.

At the ‘Semiconductor Market Prospect Seminar’ held in COEX in Gangnam on the 6th, Se-chul Lee, the managing director of Citigroup, predicted that, “Though the memory industry is currently facing a temporary downturn, its future will be bright in the long-term.”

This is in contrast with the negative predictions made by the market research company, TrendForce, which predicted a 15% decline in the 3rd quarter of this year, and up to a 20% decline in the 4th quarter.

Se-chul Lee focused on the DRAM market with its oligopolistic structure. He said, “Currently 3 companies in Samsung Electronics, SK Hynix, and Micron Technology take up over 90% of the DRAM market,” he went on to predict that, “There is an oversupply in the midst of falling demand due to worsening external conditions, such as the rise in cost of raw materials recently and the hike in interest rates, but when the issue with inventory is solved in the latter half of next year, the suppliers will lead the market.”

Se-chul Lee pointed out that, “The barriers to entry are high for DRAMS, and as a result, is structurally advantageous for suppliers,” and added on saying, “The market demand for high bandwidth memory (HBM), CXL memory, and others will continue.”

The recovery of the NAND flash market, which has more suppliers in comparison to DRAMs, is expected to be slower. The situation with Yangtze Memory Technologies Co. (YMTC) independently developing a 192-layer NAND and Chinese companies rapidly securing technologies after being invigorated by government support is worsening competition.

The semiconductor industry is also stepping up to expand their production capabilities, regardless of the short-term negative prospects of the memory industry. Samsung Electronics has started up the world’s largest memory manufacturing facility (P3) in Pyeongtaek this past July and are preparing for the construction of P4. The construction date and the product haven’t been decided yet, but it is being built to quickly deal with the changes in semiconductor demand.

In this past September, Kye-hyun Kyung, the CEO of the Samsung Electronics DS Division, accepted the prediction that the semiconductor market will be in decline until next year, but revealed that, “The basic direction for investment will stay consistent.”

SK Hynix also announced this last month, their plans to begin the construction of the expansion of M15X Fab in Cheongju, Chungcheongbukdo, investing 15 trillion KRW over 5 years. Noh-jung Kwak, the CEO of SK Hynix and chairman of the Korea Semiconductor Industry Association, met with reporters at ‘SEDEX 2022’ on the 5th and said, “The semiconductor industry will be in a different phase by the end of next year.”

Micron also announced that they would be building a new factory in New York, USA, on the 4th (local time). Micron will invest up to 100 billion dollars (around 142.03 trillion KRW) over 20 years to improve their DRAM production capabilities.

Reporter Yoon-sub Song (sys@etnews.com)