As part of the expansion of the semiconductor back-end process (OSAT) business of APACT, they are acquiring the packaging business of ATsemicon. DOOSAN TESNA confirmed acquisition of EngiOn and ABOV Semiconductor also confirmed their acquisition of WINPAC, domestic back-end process companies. The amount invested in the merger and acquisition (M&A) market alone is about 200 billion KRW. It is interpreted as their will to expand their business to system semiconductors following memory semiconductors.

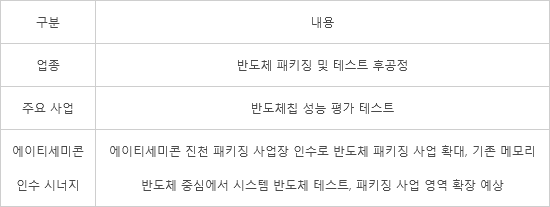

APACT is planning to complete the acquisition of ATsemicon’s Jincheon plant by the end of this month. ATsemicon is focusing on back-end process businesses such as semiconductor packaging and testing. They are acquiring the Jincheon plant of ATsemicon, which specializes in packaging outsourcing business to domestic semiconductor manufacturers such as Samsung Electronics and SK hynix. The acquisition amount alone is in the range from 70 billion to 80 billion KRW. The Jincheon plant is promoting memory semiconductor and system semiconductor packaging business, such as multi-chip packaging (MCP), which combines multiple semiconductor chips like DRAM and NAND flash into one.

With the acquisition of ATsemicon as an opportunity, APACT will expand the annual sales of the system semiconductor back-end process business to 150 billion KRW. APACT is a semiconductor OSAT company invested by OCI affiliates (UNID Global Corp.), a domestic solar company. With the support of OCI, they started this acquisition.

DOOSAN TESNA and ABOV Semiconductor also acquired domestic back-end process companies. DOOSAN TESNA is expected to complete the acquisition of EngiOn soon. With the acquisition of EngiOn, they will expand their scope to the semiconductor packaging business, such as image sensors and display driving chips. ABOV Semiconductor also completed the acquisition of WINPAC, a back-end process company. ABOV Semiconductor is expected to strengthen their semiconductor business capabilities by acquiring WINPAC. The transaction volume of DOOSAN TESNA and ABOV Semiconductor alone is estimated to be more than 70 billion KRW.

In the domestic back-end process industry, they are taking a role of raising semiconductor performance and evaluating whether there are any abnormalities of their major customers, such as Samsung Electronics and SK hynix. They are attracting attention in the semiconductor market as it significantly improves the electrical performance of semiconductors. The back-processing sector is receiving attention in the M&A market, because of the growth potential of the semiconductor market. Since system semiconductors are produced in small batches of various types, demand for back-end processing by system product is expected to increase. According to a market research company, the World Semiconductor Trade Statistics (WSTS), the system semiconductor back-end process market is expected to grow from 155 billion USD in 2021 to 181.3 billion USD (240 trillion KRW) this year.

Companies also have strong will to expand their business in the system semiconductor business. WINPAC and ATsemicon are expected to be advantageous in expanding the semiconductor business by securing new orders for Samsung Electronics' back-end processes followed by SK hynix.

<Table> Semiconductor Back-end Process business status of APACT

By Staff Reporter Ji-woong Kim (jw0316@etnews.com)