Government notices legislation on the Restriction of Special Taxation Act

Impact on operating profit of 2016 medium-sized enterprises in the metropolitan area

Industry concerns over declining digital

It is expected that the 10% corporate tax reduction benefit will disappear for 2,000 software (SW) medium-sized enterprises in the metropolitan area. SW medium-sized enterprises are those whose sales are in the range of KRW 5 billion to 80 billion.

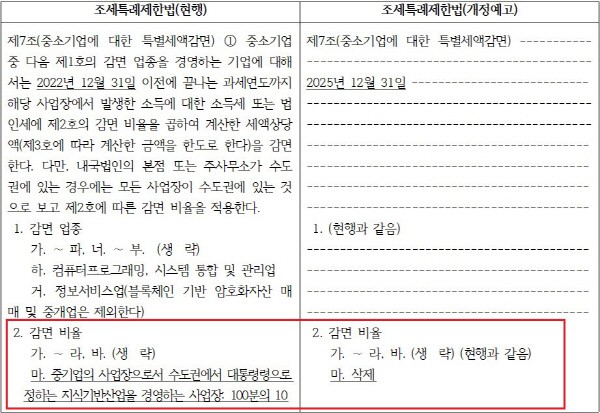

The Ministry of Economy and Finance has made an advance notice of legislation and took in opinions on the 'Partial Amendment to the Restriction of Special Taxation Act (draft)' including this information. The amendment covers various clauses that includes special taxation for small and medium-sized enterprises (SMEs) such as revitalization of corporate investment and balanced regional development, and special taxation for investment promotion and employment support.

However, it imposed an ‘abolition of the special case for medium-sized enterprises operating knowledge-based industries in the metropolitan area in order to enhance equity among related industries'.

The SW industry demanded a review since the majority of medium-sized SW companies are concentrated in the metropolitan area, and will inevitably cause a blow is inevitable.

Article 7, Paragraph 1, Item 2 (e) of the current Act imposes a ’10% corporate tax reduction for medium-sized enterprises that operate knowledge-based industries prescribed by Presidential Decree in the metropolitan area'.

SW development and supply, computer programming, system integration and management, security system service, information service, and engineering are among the knowledge-based industries that are SW-related fields.

There are 2016 medium-sized SW enterprises in the metropolitan area classified from the business report data by the Korea SW Industry Association (KOSA). It is inevitable to not take the impact on SW medium-sized enterprises since the medium-sized SW enterprises accounts for about 80% of all medium-sized enterprises (2521) and 20.7% of SW enterprises in the metropolitan area (9716), if the special tax exemption is abolished.

KOSA revealed that the overall average of profit ratio was 4.3% and that of IT service companies was very low at 2.7% from a result of the survey on the operating profit ratio of 500 medium-sized SW companies. There were concerns that the corporate tax would increase by 11%, and the operating profit margin would decrease due to the abolition of special taxation.

SW companies requested to look at the current status of importance and operation profit ratio of the SW industry before equity. Their stance is a continuous support is necessary to secure the competitiveness of the SW industry, which is the foundation of national competitiveness in the era of great digital transformation.

KOSA said, "The abolition of special taxation may lead to decrease in competitiveness of the SW medium-sized enterprises industry and a deterioration of the domestic SW industry base. We are requesting a review by the relevant ministries to ensure that medium-sized enterprises in the knowledge-based industry can be protected by maintaining special tax exemptions.”

The knowledge-based industry includes not only SW, but also telecommunications, R&D, film/video and broadcast program production, professional design business, audio publication and original recording business. Among Advertising businesses there are advertising text, design, design, writing business as well as magazine and other print publishing, creative and art-related services.

There is a growing concern that the impact will spread to various industries as the tax benefits of telecommunications, broadcasting, and content-related medium-sized companies disappear in the metropolitan area.

The Ministry of Economy and Finance plans to take legislative procedures by discussing with the Regulatory Reform Committee and the Ministry of Government Legislation.

<Table> Proportion of SW Companies in the Seoul Metropolitan Area and Other Regions (Unit: Units)

By Staff Reporter Hocheon An (hcan@etnews.com)